Effective today,

September 22, 2025, the Goods and Services Tax (GST) system in India has undergone a major overhaul, introducing a simplified structure with significant rate changes for various products and services. The previous multi-slab system (0%, 5%, 12%, 18%, 28%) has been primarily replaced by a three-slab framework: 0% (exempt), 5%, and 18%, with a special 40% rate for luxury and sin goods.

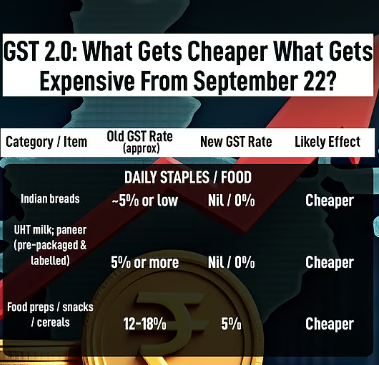

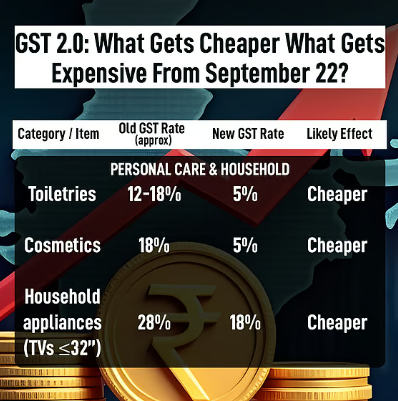

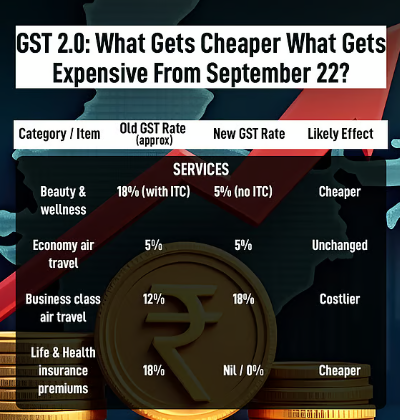

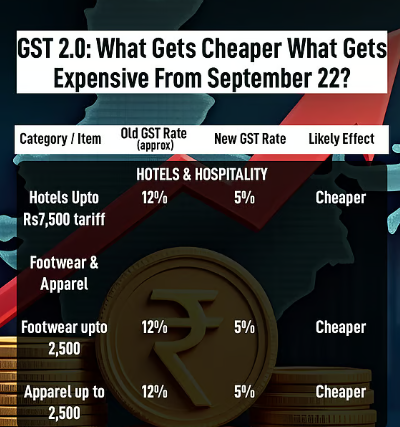

Here is a summary of key product categories and their revised GST rates:

- 0% GST (Exempt): Essential items like fresh milk, eggs, curd, unpackaged food grains, Ultra-High Temperature (UHT) milk, pre-packaged paneer, and all types of Indian breads (chapati, roti, paratha) are now exempt. Certain life and health insurance policies, 36 life-saving drugs, and some education and stationery items (e.g., pencils, sharpeners, maps) are also exempt.

- 5% GST: This “Merit Rate” covers a broad range of commonly used goods and services, often reduced from previous 12% or 18% rates. This includes:

- Food and Beverages: Most packaged food items (biscuits, namkeen, pasta, butter, ghee, cheese, dry fruits), ice cream, coffee, fruit juices, and plant-based milk drinks. Drinking water in 20-litre bottles also moves to 5%.

- Household and Personal Care: Hair oil, shampoo, soap, toothpaste, toothbrushes, household cleaners, and appliances like utensils, kitchenware, umbrellas, and bicycles. Footwear and apparel priced up to ₹2,500 also fall into this slab.

- Healthcare: Most medicines and many medical consumables (diagnostic kits, reagents, surgical instruments, thermometers) are now taxed at 5%.

- Agriculture and Manufacturing: Tractors and agricultural machinery, fertilizers, and raw materials like bamboo flooring, cement bonded particle board.

- Services: Services at salons, gyms, yoga centers, and hotel stays with tariffs between ₹1,000 and ₹7,500 per night are now at 5% GST.

- 18% GST: This “Standard Rate” is the default for most goods and services, often seeing reductions from the previous 28% slab. This includes:

- Automobiles: Small cars (under 1200cc petrol/diesel engines, under 4m length), motorcycles up to 350cc, and auto parts are now taxed at 18%. Commercial vehicles like buses and trucks also see this reduction.

- Consumer Electronics & Appliances: Air conditioners, televisions, refrigerators, washing machines, and dishwashers are now at 18% GST.

- Construction: Cement and associated materials like Portland cement and hydraulic cements are now at 18%.

- Other: Cement, coal, lignite, peat, batteries, printers, and computers are also in this slab.

- 40% GST: This highest slab applies to Luxury and “Sin” goods. This includes:

- Luxury and Sin Goods: Premium cars, motorcycles over 350cc, aerated and carbonated beverages, yachts, personal aircraft, revolvers, pistols, and activities like betting, online gaming, and casino services.

- Note: Tobacco and related products, pan masala, gutka, and cigarettes will eventually move to the 40% slab, but will continue at the existing 28% GST plus compensation cess until loan repayment obligations are met.

Key Qualitative Insights

- These reforms aim to simplify the tax structure, reduce the tax burden on consumers for essential goods, and boost economic activity, particularly in sectors like food processing, textiles, and electronics.

- The government expects the changes to provide significant savings for households, especially for daily essentials and insurance premiums, potentially freeing up to ₹2.5 lakh crore for consumers.

- Lower GST rates on automobiles and appliances are intended to stimulate demand, particularly in the run-up to the festive season.

- The higher taxes on luxury and sin goods reflect a “more income, more tax” approach aimed at discouraging consumption of non-essential or harmful products.

- The Consumer Affairs Secretary has warned companies to pass on the benefits of the GST rate cuts to consumers, threatening action against those who fail to do so

effect shown in above image that related stock effect