Here’s a

🇺🇸 Trump Threatens New Tariffs on China: Global Markets Shake as Trade Tensions Rise Again

Washington, D.C., October 11, 2025 — Former U.S. President Donald Trump has once again ignited global trade tensions after threatening a “massive increase” in tariffs on Chinese imports. The statement came shortly after China announced new restrictions on the export of rare earth minerals, a move seen as retaliation against U.S. technology sanctions.

During a press conference on Friday, Trump called China’s move “a hostile act”, accusing Beijing of trying to “hold the world hostage” through control of key industrial materials essential for semiconductors, electric vehicles, and defense technologies.

“If China wants to play tough, we’ll play tougher. The U.S. will not depend on China for anything critical ever again,” Trump declared.

💼 Tariff Plan and Possible Impact

Trump hinted at raising tariffs to as high as 60% on certain Chinese goods, particularly in electronics, batteries, and automotive parts. His administration is reportedly preparing a detailed tariff list, which could be announced later this month.

Financial analysts warn that the new tariff wave could:

- Drive up consumer prices in the U.S.

- Disrupt global supply chains once again

- Slow recovery in tech and manufacturing sectors

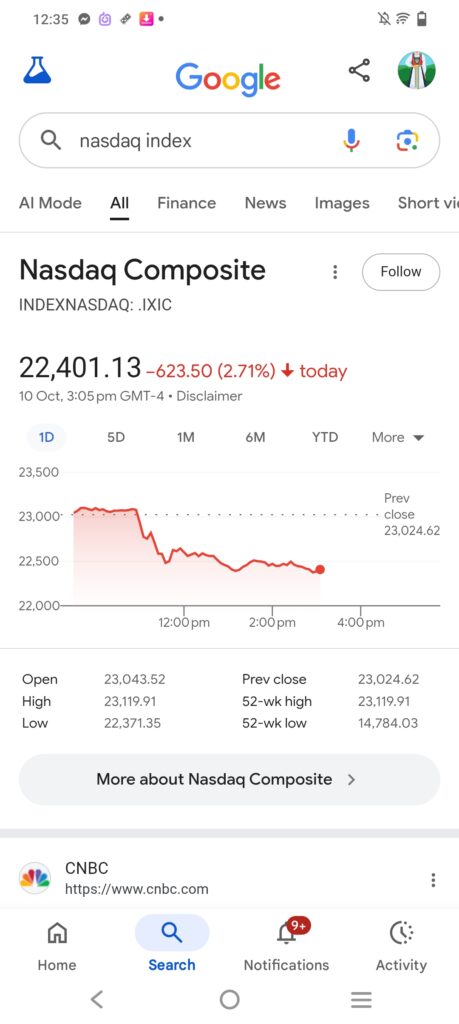

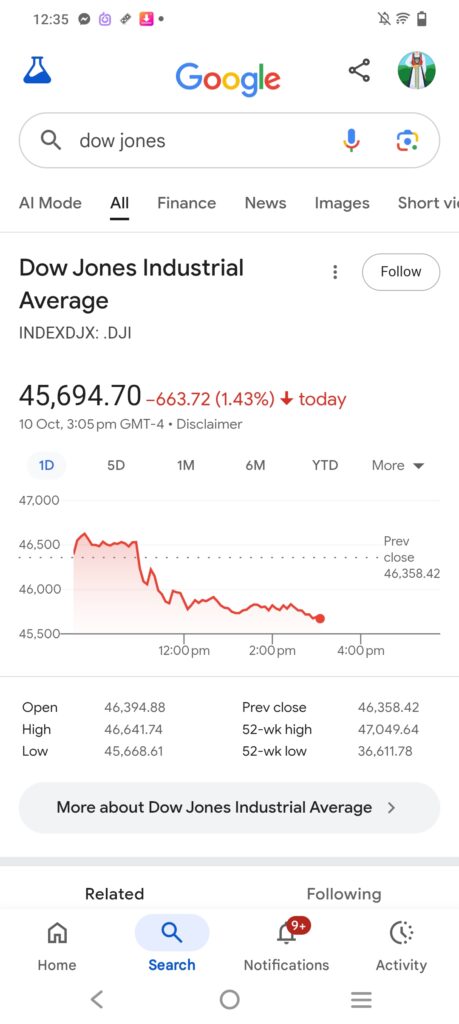

Meanwhile, Wall Street reacted swiftly — the Dow Jones fell 1.8%, the S&P 500 dropped 2.1%, and NASDAQ slipped 2.9% within hours of Trump’s announcement.

🇨🇳 China’s Reaction

In Beijing, China’s Ministry of Commerce responded sharply, stating that the U.S. move was “short-sighted and politically motivated.” Chinese state media labeled Trump’s comments as an “economic provocation”, and warned that China would retaliate proportionally if the U.S. enforces new tariffs.

“China will safeguard its national interests firmly and decisively,” a ministry spokesperson said in a televised briefing.

🌍 Global Ripple Effect

The news has already rattled global commodity and currency markets. The price of rare earth metals surged by 12%, and Asian stock markets opened lower on Saturday morning. Economists fear that another U.S.–China trade war could trigger inflation spikes and hurt developing economies dependent on exports.

European leaders have also urged both sides to “de-escalate tensions”, warning that trade disruptions could affect global manufacturing and renewable energy industries.

📈 What It Means for Investors

Experts suggest investors should keep a close eye on:

- U.S. semiconductor and EV stocks – likely to face volatility.

- Commodities like lithium and nickel – expected to surge in short-term demand.

- Defense sector and domestic manufacturing companies – could benefit if tariffs push U.S. firms to localize production.

Analysts at Morgan Stanley noted,

“This is the clearest sign yet that Trump’s economic nationalism is back — markets should prepare for a prolonged period of uncertainty.”

🧭 The Road Ahead

Trump’s statement marks a clear shift toward renewed trade protectionism, echoing the 2018–2020 tariff battles that reshaped global commerce. With the U.S. election season approaching, the tariff issue is likely to become a major political and economic flashpoint.

If enacted, the proposed tariffs could redefine the U.S.–China trade relationship, influence global supply chains, and determine the direction of world markets for years to come.

Trump Threatens New Tariffs on China – Global Markets React Sharply

Would you

Pingback: NEWSNEWS IND-US TREAD DEAL EFFECT THE ECONOMY OF INDIA AND US

Pingback: India–U.S. Trade Deal 2025 | Trump Tariff Policy and Impact