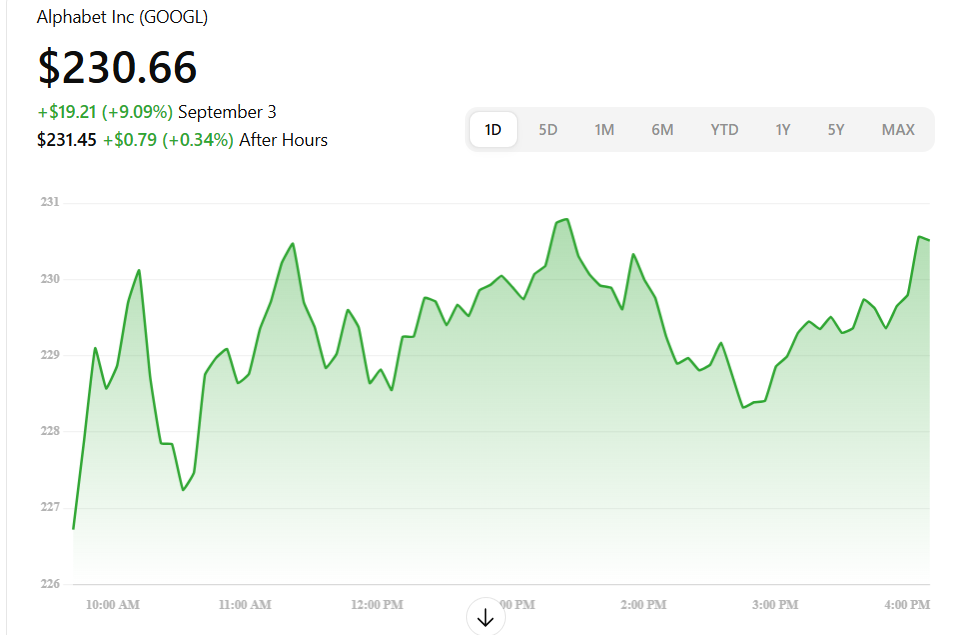

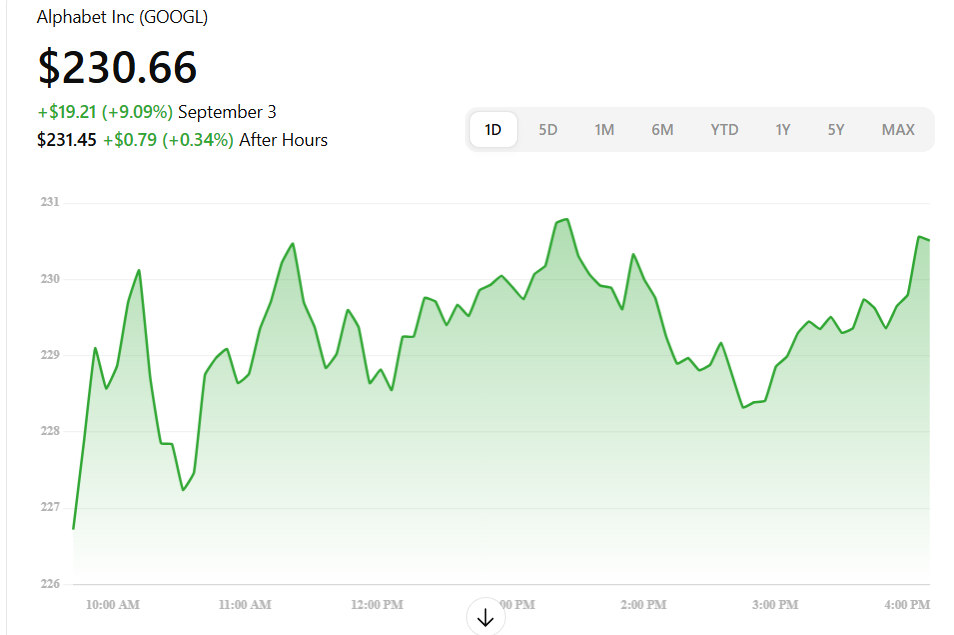

| #stock market U.S. Stock Market News 2026: What’s Driving Wall Street Right Now The U.S. stock market in 2026 stands at a crossroads of optimism and caution. After years of rapid rallies, sharp corrections, and policy-driven volatility, investors are entering a phase where fundamentals matter more than hype. Wall Street is reacting to a mix of economic resilience, evolving Federal Reserve signals, corporate earnings strength, and long-term themes such as artificial intelligence, energy transition, and reshoring of manufacturing. This year is not about blind optimism or fear-driven selling. It is about selective confidence. A Strong Start, But Not Without Questions Major U.S. stock indexes opened 2026 on a solid footing. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all posted early gains, reflecting confidence that the American economy remains durable despite global uncertainty. However, unlike earlier bull runs, this rally is more measured. Investors are no longer chasing every dip. Instead, capital is flowing into companies with strong balance sheets, predictable cash flows, and clear growth narratives. The market tone today can be described as cautiously optimistic. Federal Reserve Policy: The Market’s Biggest Trigger The Federal Reserve remains the single most powerful force influencing U.S. stocks in 2026. After aggressive rate hikes in previous years to control inflation, the Fed has shifted into a more data-dependent mode. Interest Rate Expectations Markets are pricing in the possibility of gradual rate cuts, not aggressive easing. This has created stability rather than excitement. Investors understand that premature cuts could reignite inflation, while overly tight policy could slow economic growth. This balance has helped equities remain supported without entering speculative excess. Inflation: Cooling, But Still Watched Closely Inflation in the U.S. has eased compared to its peak, but it has not disappeared. Prices for housing, healthcare, and services remain sticky, even as energy and goods inflation shows improvement. For stock markets, moderate inflation is not necessarily bad. It allows companies to maintain pricing power and protects profit margins. The concern arises only if inflation reaccelerates unexpectedly. So far, inflation trends are supportive of equity markets. Corporate Earnings: The True Foundation One of the most encouraging signals in 2026 is corporate earnings growth. Many large U.S. companies have successfully adapted to higher interest rates by cutting costs, improving efficiency, and focusing on profitable growth rather than expansion at any cost. Key Observations: Profit margins remain strong in technology and healthcare Financial companies benefit from stable interest spreads Consumer-focused brands are adjusting pricing strategies effectively Earnings quality, not just revenue growth, is what investors are rewarding. Technology Stocks: Still Leading, But More Selective Technology remains the backbone of the U.S. stock market. However, the sector has matured. The days of indiscriminate buying are gone. Artificial Intelligence Drives Momentum AI continues to be the strongest long-term theme. Companies involved in: Cloud infrastructure Semiconductor design Data analytics Automation software are seeing sustained investor interest. That said, valuations matter. Investors are favoring companies with real AI revenue, not just future promises. Nasdaq Performance: Growth With Discipline The Nasdaq Composite has outperformed traditional indexes but with noticeable pullbacks along the way. This is healthy behavior. It indicates a market that is pricing risk properly rather than chasing momentum blindly. Volatility exists, but it is constructive rather than destructive. Financial Sector: Quiet Strength Banks and financial institutions entered 2026 with stronger capital positions than in past cycles. Improved risk management, conservative lending, and stable consumer credit quality have helped restore confidence in the sector. Large banks benefit from: Stable net interest margins Strong balance sheets Improved digital efficiency While financial stocks may not deliver explosive growth, they offer stability and dividends, which appeal to long-term investors. Energy Stocks: A Balanced Revival Energy stocks have found renewed relevance in 2026. Unlike earlier cycles driven purely by oil price spikes, today’s energy rally is more balanced. Key Drivers: Increased demand for energy security Investment in clean and transitional energy Controlled supply growth Traditional oil and gas companies coexist with renewable energy firms, creating a diversified energy landscape in U.S. markets. Small-Cap Stocks: A Potential Opportunity Small-cap stocks lagged large-cap stocks in recent years, but 2026 may be a turning point. As borrowing costs stabilize and domestic economic activity improves, smaller companies could see renewed interest. Investors are watching: Regional manufacturing growth Infrastructure spending Domestic supply chain investments If interest rates ease gradually, small-cap stocks could outperform. Consumer Sentiment and Spending Trends American consumers remain resilient. While spending patterns have shifted, overall consumption has not collapsed. Consumers are: Spending more selectively Prioritizing value over luxury Reducing discretionary debt This behavior supports steady earnings growth for well-managed consumer brands while punishing companies dependent on impulse spending. Labor Market: Slowing, Not Collapsing Job growth has slowed compared to previous years, but the labor market remains stable. Wage growth is moderating, which reduces inflation pressure while keeping employment healthy. For the stock market, this is an ideal scenario: No overheating No sharp unemployment spike Sustainable consumer demand Market Volatility: A New Normal Volatility in 2026 is not a sign of weakness. It reflects a market that is adjusting to real economic signals rather than reacting emotionally. Investors are responding to: Earnings reports Economic data releases Policy statements This creates short-term swings but supports long-term stability. Investor Behavior Has Changed One of the biggest shifts in the U.S. stock market is investor maturity. Retail investors are more informed, institutions are more disciplined, and speculative excess is lower than in past cycles. This reduces the risk of extreme bubbles while increasing the importance of fundamentals. Global Factors Influencing U.S. Markets U.S. stocks do not exist in isolation. Global developments continue to influence Wall Street. Key global considerations include: Trade relationships Currency movements Geopolitical stability International growth trends Despite global challenges, U.S. markets remain a preferred destination for capital due to transparency and liquidity. Long-Term Outlook for U.S. Stocks Looking ahead, the long-term outlook for U.S. equities remains positive. Innovation, entrepreneurship, and capital efficiency continue to drive growth. However, returns are likely to be more normalized, not explosive. Investors should expect: Moderate annual gains Periodic corrections Sector rotation Patience and discipline will be more important than speculation. Smart Investment Strategy for 2026 For investors navigating the U.S. stock market in 2026: Focus on companies with strong cash flow Avoid excessive leverage Diversify across sectors Think long-term, not short-term noise The market rewards preparation, not prediction. Conclusion: A Market Built on Reality The U.S. stock market in 2026 is not driven by fantasy or fear. It is shaped by real earnings, realistic expectations, and disciplined policy. This is a healthier market — one that may not deliver overnight riches but offers sustainable wealth creation for those willing to stay invested, informed, and patient. Wall Street is no longer chasing dreams. It is building value. |

stock market to UniversalCheack – Smarter Market Insights for Smarter Investors

UniversalCheack is your trusted partner in the world of finance and stock markets. Our goal is to make investing simpler, clearer, and more accessible for everyone—from beginners exploring their first stocks to professional traders looking for daily market analysis.

We deliver real-time updates, expert insights, and data-driven recommendations to help you make informed financial decisions.

stock market What You’ll Find on UniversalCheack

- Live Stock Market News

Stay updated with the latest from Dow Jones, NASDAQ, NIFTY, Sensex, and global indices. - Stock Picks with Buy Price, Stop-Loss & Target

Practical, human-analyzed insights that help you minimize risks and maximize profits. - Global Market Trends

Understand how U.S., European, and Asian stock movements influence your investments. - Learning Hub for Beginners

Easy-to-follow guides on trading basics, long-term investing, and financial planning. - Expert Articles & Market Research

Deep-dive analysis of sectors, companies, and emerging opportunities.

stock market Why Choose UniversalCheack?

✅ Reliable & Human-Written Content – No AI noise, just clear market insights.

✅ Daily Market Updates – Stay ahead with fresh analysis every day.

✅ Simple & Beginner-Friendly – Designed for readers at all levels.

✅ SEO-Optimized Finance Resource – Content tailored to reach the right audience.

✅ Global + Local Coverage – From Wall Street to Dalal Street.

stock market Start Your Investment Journey Today

Whether you’re looking for the best stocks to buy today, planning long-term wealth, or following daily market news, UniversalCheack is your one-stop finance destination.

👉 Explore the latest stock updates, expert analysis, and actionable insights now.

📩 Subscribe to our newsletter for daily stock recommendations and market tips straight to your inbox.

Featured Post

Duis sed consectetur dui quaerat consectetur nulla nec corrupti lacus.

Xabi Alonso’s Incredible Rise: The Powerful Football Mastermind Redefining the Modern Game

Xabi Alonso’s Incredible Rise: The Powerful Football Mastermind Redefining the Modern Game Introduction: Why Xabi…

Warriorz vs Royal Challengers Unleashed: The Explosive WPL Battle That Ignites Women’s Cricket

Warriorz vs Royal Challengers Unleashed: The Explosive WPL Battle That Ignites Women’s Cricket The keyword…

Texans games are becoming must-watch football.

Texans Game-Day Experience, History, Analysis, and Future Outlook Texans games are becoming must-watch football The…

Aaron Rodgers Wife: The Honest Truth About His Relationship Status, Love Life, and Rumors

4 Aaron Rodgers Wife: The Honest Truth About His Relationship Status, Love Life, and Rumors…

Lakers vs Kings: The Explosive NBA Rivalry That Continues to Captivate Basketball Fans

The Explosive NBA Rivalry That Continues to Captivate Basketball Fans The matchup both is one…

“Best Stocks to Buy Today – UniversalCheack Market Insights”