New US Tariffs

New US Tariffs News 2026: How Trade Duties Are Reshaping the American Economy

Tariffs are once again at the center of economic debate in the United States. In 2026, U.S. tariff policy is no longer just a trade issue—it has become a powerful tool shaping inflation, manufacturing, geopolitics, and even stock market sentiment. From renewed duties on strategic imports to selective relief for critical industries, tariffs are influencing how America trades with the world.

Unlike earlier tariff cycles driven by sudden political announcements, today’s approach is more calculated, sector-specific, and closely tied to national security and supply-chain resilience.

What Are New US Tariffs and Why They Matter in 2026

Tariffs are taxes imposed on imported goods. While simple in theory, their economic impact is complex. In 2026, tariffs affect:

- Consumer prices

- Corporate profit margins

- Manufacturing investment

- Global trade relationships

- Currency movements

The U.S. government uses tariffs to protect domestic industries, reduce reliance on foreign supply chains, and gain leverage in international negotiations.

Recent Developments in New US Tariffs Policy

The current U.S. tariff environment reflects a strategic rather than aggressive posture. Instead of broad blanket tariffs, the focus is on targeted duties tied to:

- Advanced technology

- Clean energy components

- Steel and aluminum

- Electric vehicles and batteries

- Semiconductors

This shift signals that tariffs are being used as industrial policy tools, not just trade weapons.

New US Tariffs–China Tariff Landscape

Trade relations between the United States and China remain one of the most influential factors in global commerce. While full-scale tariff escalation has slowed, existing duties remain in place across several categories.

Key Points:

- High tariffs continue on select Chinese tech and industrial goods

- Strategic decoupling is replacing total disengagement

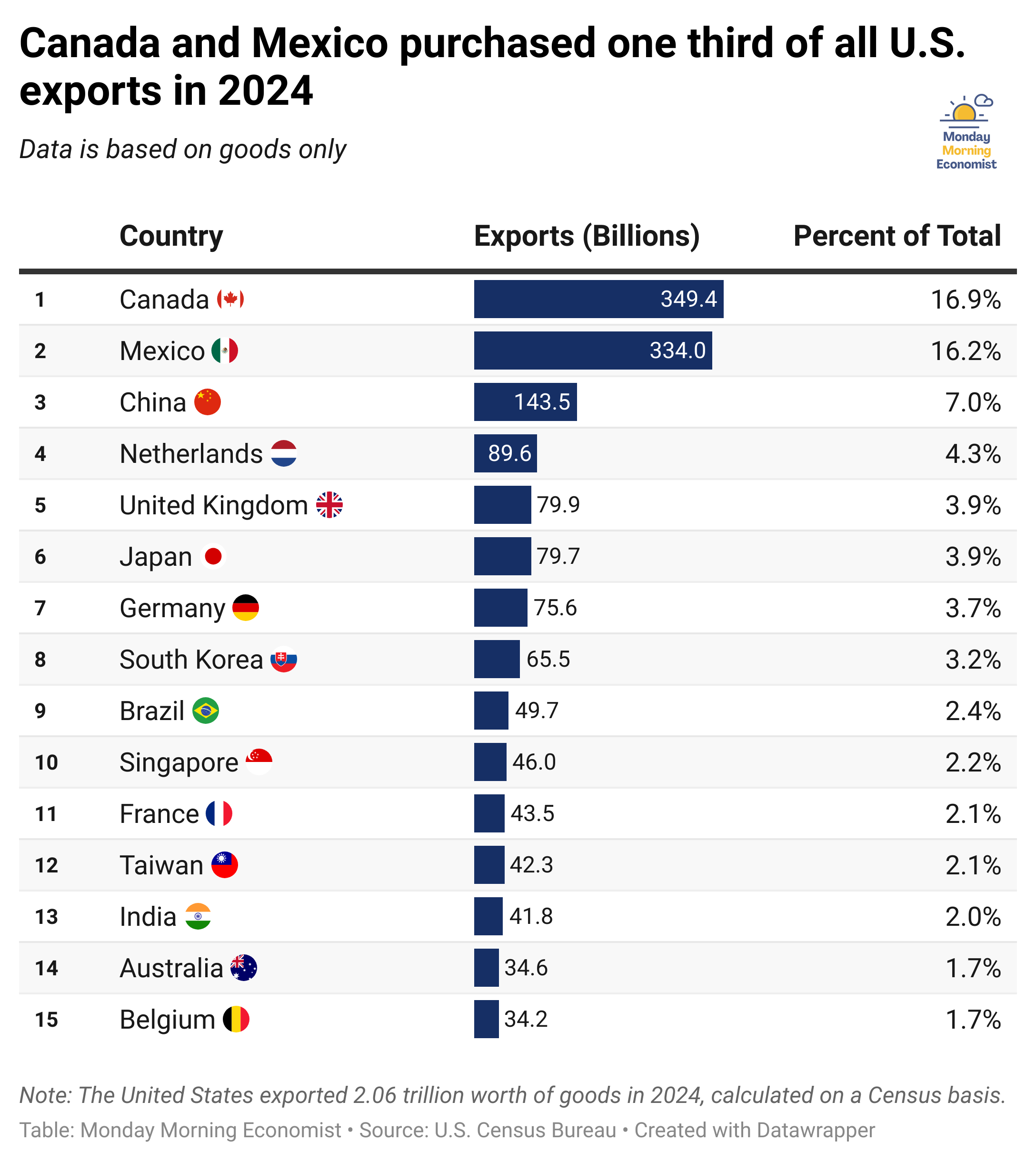

- U.S. companies are diversifying supply chains toward India, Vietnam, and Mexico

Rather than reversing tariffs entirely, the U.S. is adjusting them to align with long-term economic security.

Impact on American Consumers

One of the most debated aspects of tariffs is their effect on consumer prices. In 2026, the impact is uneven.

What Consumers Are Seeing:

- Higher prices for imported electronics and appliances

- Stable pricing in domestically produced goods

- Gradual normalization as supply chains adapt

Retailers have become better at absorbing or offsetting tariff costs, reducing the shock felt by households compared to earlier years.

Manufacturing: New US Tariffs-Driven Revival

Tariffs have played a role in encouraging domestic manufacturing investment. While not the sole factor, they have accelerated decisions to build and expand facilities within the U.S.

Benefiting Industries:

- Steel and metal fabrication

- Semiconductor manufacturing

- Automotive and EV components

- Defense and aerospace

Many companies now view domestic production as a long-term risk management strategy, not just a response to tariffs.

New US Tariffs and Inflation: A Delicate Balance

Tariffs can contribute to inflation by raising input costs. However, in 2026, the inflationary impact of tariffs is moderate rather than extreme.

Why?

- Improved logistics efficiency

- Supplier diversification

- Greater domestic sourcing

The Federal Reserve closely monitors tariff-related price pressures when making interest rate decisions, but tariffs are no longer the dominant inflation driver.

Effect on the New US Tariffs Stock Market

Tariff news continues to influence stock market sentiment, especially in trade-sensitive sectors.

Market Reactions:

- Manufacturing stocks often rise on protective tariffs

- Retail and import-heavy companies face pressure

- Technology stocks react to semiconductor trade rules

Investors have become more selective, pricing tariffs into long-term earnings expectations rather than reacting emotionally.

Small Businesses and Importers

Smaller businesses face greater challenges adapting to tariffs. Unlike large corporations, they often lack bargaining power and alternative sourcing options.

Common responses include:

- Passing costs to customers

- Reducing product variety

- Switching suppliers

- Seeking tariff exemptions

Government support programs and trade adjustment assistance have become more important for small enterprises.

New US Tariffs Exemptions and Relief Measures

The U.S. government continues to offer tariff exclusions for certain products where domestic supply is insufficient.

These exemptions help:

- Healthcare equipment suppliers

- Renewable energy projects

- Infrastructure developers

Such relief ensures that tariffs do not unintentionally slow critical national priorities.

Global Trade and Retaliatory New US Tariffs

Tariffs rarely exist in isolation. Other countries respond with their own measures, affecting U.S. exports.

Affected Sectors:

- Agriculture

- Aircraft manufacturing

- Automotive exports

- Consumer goods

To manage this, the U.S. increasingly relies on bilateral agreements rather than multilateral tariff battles.

New US Tariffs and Supply Chain Realignment

One of the most lasting effects of tariffs has been the restructuring of global supply chains.

Trends include:

- Nearshoring to Mexico

- Friend-shoring to allied nations

- Reduced dependency on single-country suppliers

Tariffs have accelerated changes that were already underway due to pandemic disruptions and geopolitical risks.

Clean Energy and New US Tariffs Policy

Tariffs now play a role in the U.S. clean energy transition. Duties on imported solar panels, batteries, and EV components aim to support domestic production while balancing climate goals.

This has created:

- Short-term cost increases

- Long-term domestic capacity growth

The challenge lies in protecting local industry without slowing adoption of green technologies.

Political Debate Around New US Tariffs

Tariffs remain politically sensitive. Supporters argue they protect jobs and national security. Critics warn they raise costs and strain alliances.

In 2026, the debate is less ideological and more practical:

- Which tariffs deliver results?

- Which create unintended harm?

- How long should tariffs remain in place?

This pragmatic approach reflects lessons learned from earlier trade conflicts.

What Businesses Are Doing to Adapt

Successful companies are not waiting for tariff relief. They are adapting through:

- Supply chain diversification

- Long-term sourcing contracts

- Automation and efficiency upgrades

- Strategic pricing models

Tariffs are now treated as a permanent risk factor, not a temporary disruption.

Future Outlook for New US Tariffs Policy

Looking ahead, U.S. tariff policy is expected to remain:

- Targeted rather than broad

- Aligned with industrial strategy

- Integrated with foreign policy goals

Rather than sudden changes, businesses should expect gradual adjustments based on economic and geopolitical developments.

Conclusion: New US Tariffs as a Strategic Tool, Not a Shock Weapon

In 2026, tariffs are no longer surprises that rattle markets overnight. They are calculated instruments shaping how America competes globally.

While challenges remain, the U.S. has moved toward a more balanced use of tariffs—protecting critical industries, managing inflation risks, and encouraging resilient supply chains.

For investors, businesses, and consumers, understanding tariff policy is no longer optional. It is essential.

500% New US Tariffs Explained: Which Countries Are Affected and Why the World Is Watching Closely

In recent months, global markets and governments have been buzzing with one dramatic phrase: a 500% tariff. Such a figure is almost unheard of in modern international trade, immediately raising alarm bells across financial markets, export industries, and diplomatic circles. But what exactly does this proposed tariff mean, which countries could be affected, and why has it become such a major global talking point?

To understand the seriousness of the issue, it’s important to look beyond headlines and examine the political, economic, and strategic context behind this proposal.

What Is the 500% New US Tariffs?

A 500% tariff refers to a proposed trade penalty that would allow the United States to impose import duties of up to five times the value of goods coming from certain countries. In practical terms, this level of tariff would make exports from affected countries commercially unviable in the U.S. market.

Such a tariff is not meant to regulate trade in the traditional sense. Instead, it acts as a punitive economic weapon, designed to force a change in policy rather than simply protect domestic industries.

Why Is the U.S. Considering Such an Extreme Tariff?

The proposal is linked to geopolitical pressure, not normal trade disputes. U.S. lawmakers backing the measure argue that some countries are indirectly supporting Russia’s economy by continuing to purchase Russian oil, gas, and strategic resources.

According to supporters of the bill, revenues from these energy exports help sustain Russia’s economy during the ongoing conflict in Ukraine. The 500% tariff is intended to discourage third-party countries from maintaining those trade ties.

In short, the tariff is about foreign policy enforcement, not trade competition.

Is the 500% New US Tariffs Already in Force?

No.

This is a proposed measure, not an active tariff.

The idea has been introduced through proposed U.S. legislation and political statements. Whether it becomes law depends on congressional approval, executive enforcement decisions, and potential diplomatic negotiations.

That uncertainty alone is enough to unsettle global markets.

Which Countries Could Face a 500% New US Tariffs?

The proposed tariff would not target Russia directly. Instead, it focuses on countries that continue to buy Russian energy products. Based on current global trade patterns, several countries are frequently mentioned as being at risk.

🇮🇳 India

India has significantly increased its imports of Russian crude oil over the past few years, mainly due to discounted pricing and energy security needs.

If the 500% tariff proposal were enacted in its strictest form, Indian exports to the U.S. could face severe penalties. This would impact sectors such as:

- Pharmaceuticals

- IT services

- Textiles

- Engineering goods

India has maintained that its energy purchases are driven by national interest and affordability, not political alignment.

🇨🇳 China

China is the largest buyer of Russian energy products. As a result, it is considered one of the most exposed countries under the proposed tariff framework.

Given the already tense U.S.–China trade relationship, the idea of a 500% tariff raises concerns about:

- Supply chain disruptions

- Increased inflation

- Escalation of trade retaliation

China has historically responded strongly to U.S. trade restrictions, making this scenario especially sensitive.

🇧🇷 Brazil

Brazil is another country mentioned in discussions around the proposed tariff. While not as heavily dependent on Russian oil as India or China, Brazil’s continued trade links place it within the scope of the proposal.

Brazil’s exports of agricultural products, metals, and manufactured goods could face significant challenges if targeted.

🇪🇺 Parts of the European Union

Although the European Union has officially imposed sanctions on Russia, some EU countries continue to import Russian energy indirectly through intermediaries and global markets.

This creates a complicated situation where select EU trade flows could theoretically fall under the tariff’s scope, even if unintentionally.

Why a 500% New US Tariffs Is So Controversial

A tariff of this magnitude is controversial for several reasons:

1. It Breaks Trade Norms

Most international trade disputes involve tariffs between 5% and 50%. A 500% tariff effectively acts as a trade ban, not a tax.

2. It Punishes Third Parties

The measure does not directly target Russia but instead penalizes countries pursuing their own energy strategies.

3. It Risks Global Retaliation

Affected countries could respond with counter-tariffs, restrictions on U.S. companies, or alternative trade alliances.

Impact on Global Trade and Supply Chains

If implemented, a 500% tariff could reshape global trade patterns almost overnight.

Likely Consequences:

- Diversion of exports away from the U.S.

- Higher costs for American consumers

- Acceleration of non-U.S. trade blocs

- Increased use of local currencies instead of the dollar

Global supply chains that took years to stabilize after the pandemic could face renewed stress.

Impact on the U.S. Economy New US Tariffs

While the tariff is intended to apply pressure internationally, it would also affect the U.S. economy.

Potential Effects:

- Higher prices for imported goods

- Reduced availability of certain products

- Pressure on U.S. manufacturers reliant on foreign inputs

- Market volatility

Economists warn that extreme tariffs often produce unintended domestic consequences.

How Markets Have Reacted

Even without formal implementation, the mere discussion of a 500% tariff has already influenced:

- Stock market volatility

- Currency movements

- Commodity prices

- Investor sentiment

Markets dislike uncertainty, and the lack of clarity around enforcement has created caution across global exchanges.

Diplomatic Responses So Far New US Tariffs

Countries potentially affected by the tariff have responded cautiously. Most have avoided direct confrontation while emphasizing:

- Energy security needs

- Sovereign trade decisions

- Commitment to diplomatic dialogue

Behind the scenes, negotiations and lobbying efforts are ongoing to prevent escalation.

Can the Tariff Be Avoided?

Yes, potentially.

Most versions of the proposal include waiver provisions, allowing the U.S. President to suspend or modify tariffs if doing so serves national interests. This leaves room for:

- Diplomatic compromises

- Energy trade adjustments

- Temporary exemptions

This flexibility suggests the tariff is designed as a pressure tool, not an automatic punishment.

Why This Matters Beyond 2026 New US Tariffs

The 500% tariff debate is about more than one conflict or trade relationship. It signals a broader shift in how economic power is used globally.

Trade policy is no longer just about goods and services. It has become a tool for:

- Security enforcement

- Alliance management

- Economic influence

How this situation unfolds may define global trade rules for the next decade.

What Businesses Should Do Now New US Tariffs

Companies involved in international trade should:

- Monitor policy developments closely

- Diversify export markets

- Strengthen supply chain flexibility

- Prepare contingency pricing strategies

Ignoring the issue could be costly.

Conclusion: A Warning Shot, Not a Final Decision New US Tariffs

The proposed 500% tariff is one of the strongest trade threats seen in modern times. While it has not yet been implemented, its mere presence has already influenced global behavior.

For now, it serves as a warning shot—a signal of how far economic pressure could go if diplomatic solutions fail.

Whether it becomes reality or fades into negotiation history will depend on global cooperation, political decisions, and economic priorities in the months ahead.

US Supreme Court Tariff Decision That Could Shock the Economy 5 Key Impacts

- No outbound links were found. Link out to external resources.

- We found 0 outbound links in your content and all of them are do-follow.