📈 Intraday Stock Picks Today: Buy–Sell Levels, Targets & Stop-Loss (High-Volume Trading List)

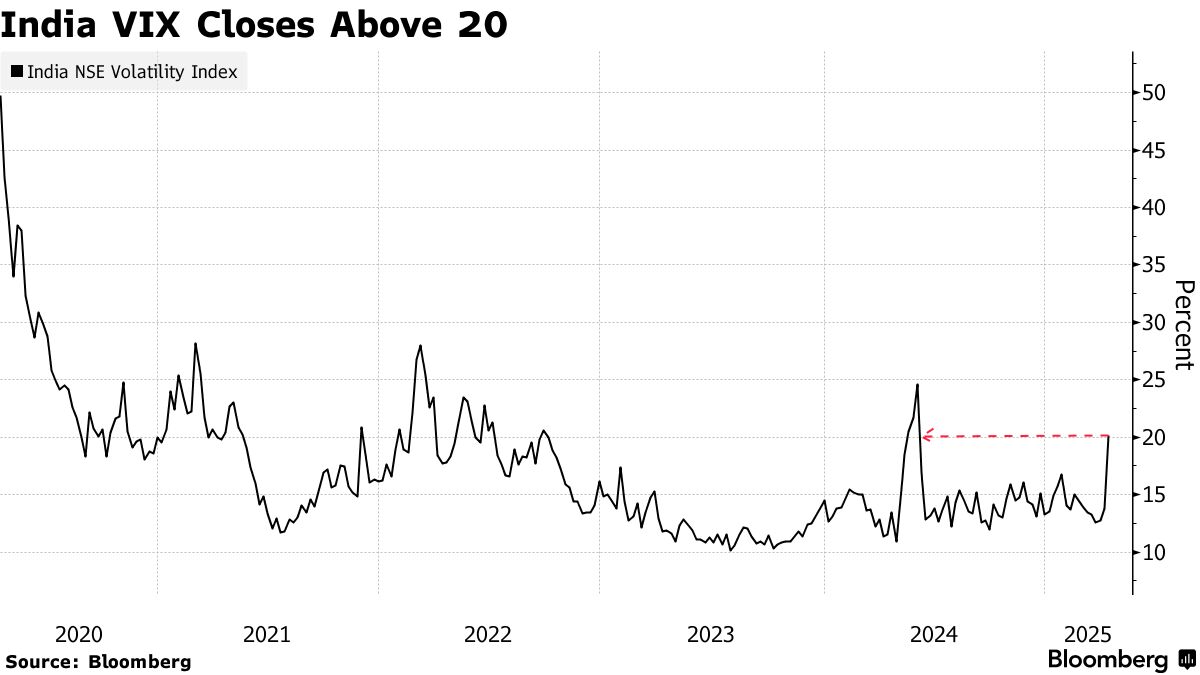

Intraday trading remains one of the most actively followed strategies in the Indian stock market, especially during periods of high volatility, sector rotation, and institutional activity. Based on price action, volume participation, and momentum, the following stocks are ideal for intraday buy or sell trades, provided strict stop-loss discipline is followed.

This report converts your raw intraday stock list into a professional, human-written market outlook, helping traders understand where to buy, where to exit, and how to manage risk.

🔍 How to Read This Intraday Stock

Each stock in this list includes:

- Intraday Target – Expected upside if momentum continues

- Intraday Stop-Loss – Risk protection level

- Current Price Zone – Ideal entry area

- Volume % – Strength of participation (higher = stronger conviction)

⚠️ Intraday trading is risky. Always trade with stop-loss and position sizing.

🚀 High-Momentum Intraday Stocks (Strong Volume Participation)

🔹 Suprajit Engineering – High Conviction Trade

- Price Zone: ₹460.05

- Target: ₹471.55

- Stop-Loss: ₹437.05

- Volume Strength: 83%

Suprajit Engineering is showing strong intraday accumulation, supported by exceptional volume. The stock is trading above short-term averages, indicating bullish continuation. Traders can look for buy-on-dip opportunities, keeping a strict stop-loss.

Intraday View: Bullish above ₹455

Risk–Reward: Favorable

🔹 Akash Infra – Momentum with Liquidity Intraday Stock

- Price: ₹34.09

- Target: ₹34.94

- Stop-Loss: ₹32.39

- Volume: 70%

Akash Infra has gained trader interest due to unusual volume spikes. Price action suggests a range breakout attempt, making it suitable for quick scalping or momentum trades.

🔹 Krystal Integrated – Volume-Backed Breakout Intraday Stock

- Price: ₹623.90

- Target: ₹639.50

- Stop-Loss: ₹592.70

- Volume: 65%

Krystal Integrated is holding gains with steady buying pressure. As long as the stock sustains above ₹620, intraday traders may see follow-through buying.

🔹 Asian Energy & Andhra Cements – Infra Theme Active

Both stocks are showing sectoral participation.

| Stock | Price | Target | Stop-Loss |

|---|---|---|---|

| Asian Energy | ₹266.90 | ₹273.57 | ₹253.56 |

| Andhra Cements | ₹72.30 | ₹74.11 | ₹68.68 |

Infra and cement stocks often move together intraday when institutional flows enter the sector.

⚙️ Mid-Cap & Small-Cap Intraday Opportunities

🔹 Yasho Industries

- Price: ₹1373.60

- Target: ₹1407.94

- Stop-Loss: ₹1304.92

- Volume: 36%

A volatile stock suitable only for experienced intraday traders. High price swings mean higher risk but also better reward.

🔹 Ausom Enterprise & Modi Naturals

These stocks are showing gradual intraday build-up, ideal for range trading strategies.

- Ausom Enterprise: Target ₹134.91 | SL ₹125.04

- Modi Naturals: Target ₹362.29 | SL ₹335.77

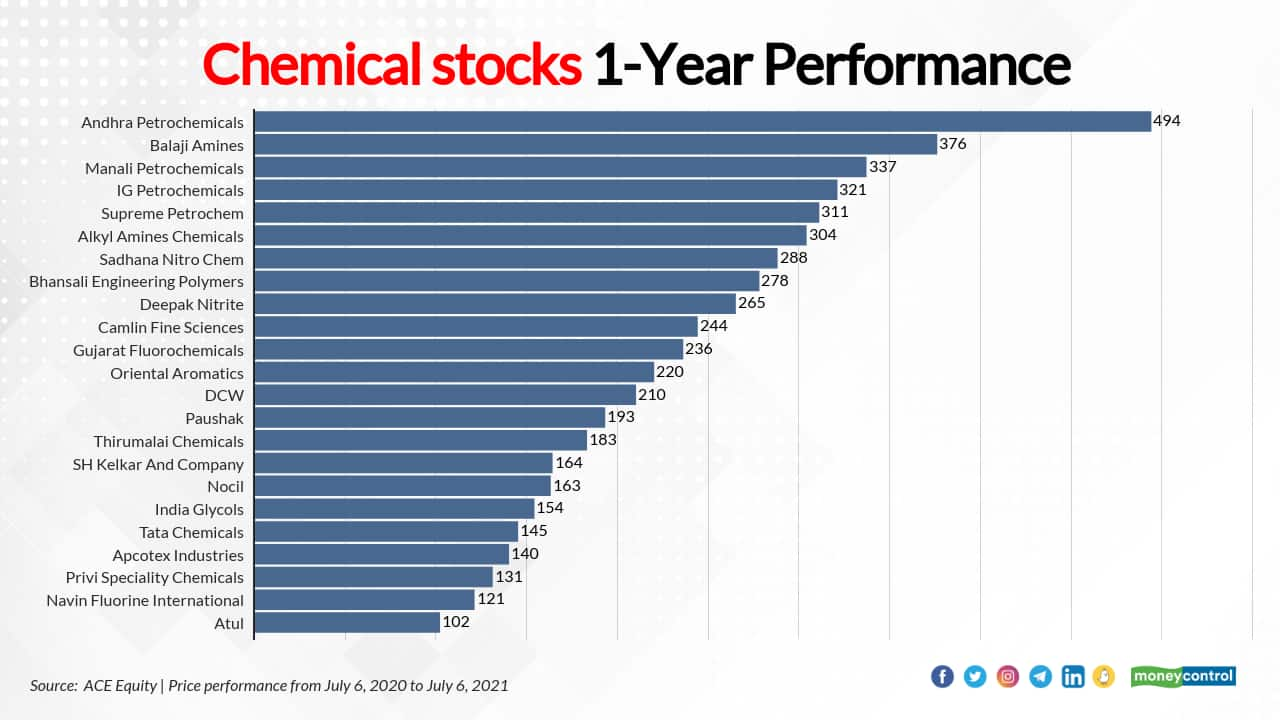

🧪 Pharma & Specialty Chemical Intraday Picks

🔹 Aarti Pharmalabs

- Price: ₹761.75

- Target: ₹780.79

- Stop-Loss: ₹723.67

Pharma stocks often provide defensive intraday moves, especially on volatile market days.

🔹 Mangalam Drugs, IPCA Laboratories, Alkem Labs

These stocks show technical stability and are best suited for low-risk intraday traders.

🏭 Engineering, PSU & Large-Cap Intraday Trades

🔹 MTAR Technologies

- Price: ₹2689.70

- Target: ₹2756.94

- Stop-Loss: ₹2555.22

A favorite among high-beta intraday traders, MTAR reacts sharply to volume bursts.

🔹 Bharat Heavy Electricals (BHEL)

- Price: ₹274.25

- Target: ₹281.11

- Stop-Loss: ₹260.53

PSU stocks like BHEL remain in focus due to government capex themes.

🔹 Mazagon Dock, Siemens, ABB India

These stocks are suitable for institutional-style intraday trading, where price + volume confirmation is essential.

🏨 Consumer, Retail & Service Stocks (Low-Risk Intraday)

- Juniper Hotels

- Medplus Health

- Mahindra Holidays

- Tips Music

These stocks generally move in controlled ranges, ideal for scalpers and conservative traders.

🏦 Banking, NBFC & Financial Stocks

- LIC Housing Finance

- Ujjivan Small Finance Bank

- Indus Towers

Financial stocks often show trend-based intraday moves, especially when Nifty Bank is active.

📊 How Traders Can Use This Intraday List Effectively

✅ Best Practices

- Enter trades only after volume confirmation

- Do not average losing positions

- Use 1–2% capital risk per trade

- Book partial profits near target

- Exit all intraday trades before market close

⚠️ Risk Disclosure (Very Important)

This intraday stock list is for educational and informational purposes only.

Stock market trading involves risk. Prices can move against expectations due to news, global markets, or sudden volatility.

US Supreme Court Tariff Decision That Could Shock the Economy 5 Key Impacts