📰 Global Stock Market News

Here are the latest highlights from world markets:

- Asia: Asian stock markets are near record highs. The rally is driven by expectations of U.S. interest rate cuts, a weaker dollar, and strong demand for technology, especially semiconductors in Japan, South Korea, and Taiwan.

- United States: Oracle surged after announcing new artificial intelligence (AI) contracts, lifting the tech sector. U.S. inflation at the producer level (PPI) has eased, and some weakness in job data is raising hopes that the Federal Reserve may cut interest rates soon.

- Europe: Investors are cautious ahead of the European Central Bank (ECB)’s next decision. Debt concerns in France and political uncertainty remain in focus, while large exporters like Airbus and LVMH provide some balance.

📈 Stocks & Sectors to Watch

Here are some stocks and themes analysts and traders are keeping an eye on:

| Stock / Sector | Why It’s Worth Watching |

|---|---|

| Micron Technology (MU) | Analysts continue to rate it a “buy.” Memory chips and semiconductors are in high demand thanks to AI growth. |

| Oracle (ORCL) | Recently secured major AI cloud deals. Investors see strong momentum in enterprise tech. |

| AI & Tech Leaders (NVIDIA, Microsoft, Google, Amazon) | AI remains the hottest growth theme, fueling demand for chips, cloud, and automation tools. |

| Asian Tech & Semiconductors | Japanese, Korean, and Taiwanese chipmakers are benefitting from global demand and favorable currency trends. |

| French Luxury (LVMH, Hermès, Kering) | Even with political uncertainty, luxury exports remain resilient and attract global investors. |

🎯 How to Think About Target Price & Stop Loss

I can’t give you licensed investment advice, but here’s a framework to help you set your own buying levels, targets, and stop losses:

1. Technical Analysis

- Check the price chart across multiple timeframes (daily, weekly, monthly).

- Identify resistance (levels where price struggles to go up) and support (levels where it tends to hold).

- Use indicators like moving averages (50-day, 200-day), RSI, MACD for confirmation.

2. Fundamental Analysis

- Look at earnings growth, revenue trends, debt, and cash flow.

- Compare valuation multiples (P/E ratio, Price/Sales) with peers.

- Consider company-specific risks: regulation, supply chain, reliance on a single market.

3. Setting a Target Price

- Base it on expected earnings growth and peer comparisons.

- Example: If analysts expect 20% earnings growth in 12 months, you can project a target price 20% higher than today’s level (adjusting for valuation).

4. Setting a Stop Loss

- Decide in advance how much you’re willing to lose if the trade goes against you.

- Common strategies:

- Percentage-based (e.g., stop loss at -7% to -10% below your buy price).

- Technical-based (place it just below a strong support level).

- Don’t move the stop loss unless your analysis changes.

🔑 Takeaway

- U.S. market: Strong momentum thanks to AI, tech, and hopes for Fed rate cuts.

- Europe (France): Cautious outlook due to political and debt issues, but luxury and aerospace remain resilient.

- Asia: Semiconductor boom continues, supported by global AI demand and favorable monetary policies.

👉 A smart investor could balance growth opportunities in the U.S. and Asia with stability in European blue chips (luxury, aerospace, energy).

ample Watchlist: 10 Stocks (US + Europe)

Below are 6 US stocks + 4 European (including France) stocks.

| No. | Stock / Ticker | Recent Price* | Potential Buy Zone / Entry Idea | Estimated Target Price | Suggested Stop Loss | Main Strengths & Risks |

|---|---|---|---|---|---|---|

| US Stocks | ||||||

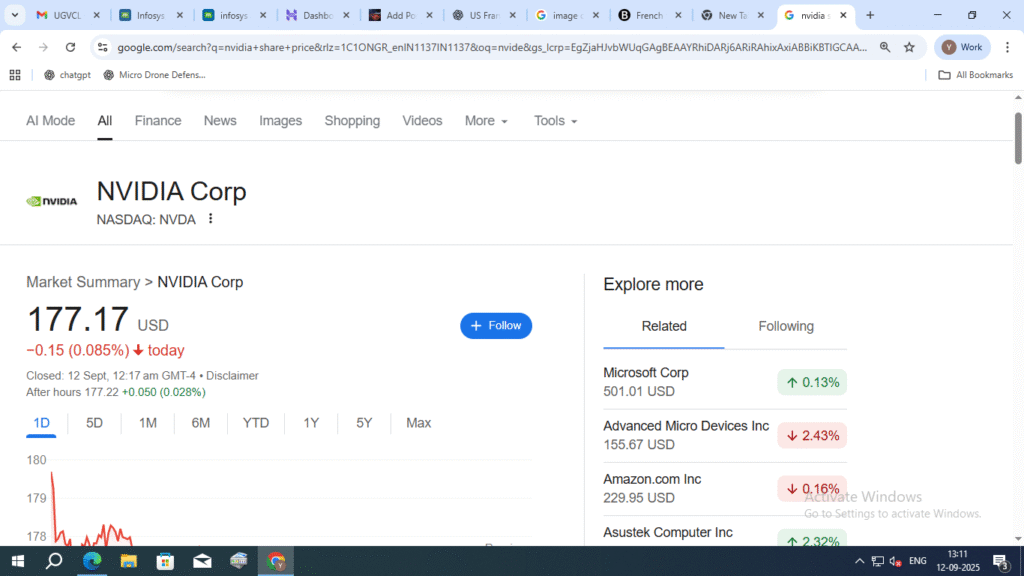

| 1 | NVIDIA (NVDA) | ~ US$177.17 TradingView | Might consider buy near US$160-170 if there is a pullback. Above current is OK if momentum strong. | US$210-230 | ~ US$140-150 (if major support breaks) | Strong AI / GPU demand. Risks: high valuation, regulatory/trade issues. |

| 2 | Microsoft (MSFT) | ~ US$501.01 TradingView | Entry could be US$460-500 zone. If dip, lower. | US$600-650 | ~ US$420-450 | Very strong cash flow, diversified business. Risks: macro slowdown, competition, regulatory pressure. |

| 3 | Apple (AAPL) | ~ US$230.03 TradingView | Buy zone maybe US$210-230 | US$280-320 | ~ US$180-200 | Brand strength, recurring revenue. Risks: demand issues, supply chain, rising costs. |

| 4 | Amazon (AMZN) | ~ US$229.95 TradingView | Entry maybe US$200-230 | US$300-350 | ~ US$160-180 | E-commerce + cloud growth. Risks: margin pressure, macro, competition. |

| 5 | Oracle (ORCL) | — (recent big moves) Reuters+1 | Could enter on dips to cloud/AI optimism, maybe ~ US$120-140 zone depending on recent base | US$180-200 | Below key support, maybe ~ US$100-110 | Strong AI/cloud contracts; risk of competitor disruption, macro headwinds. |

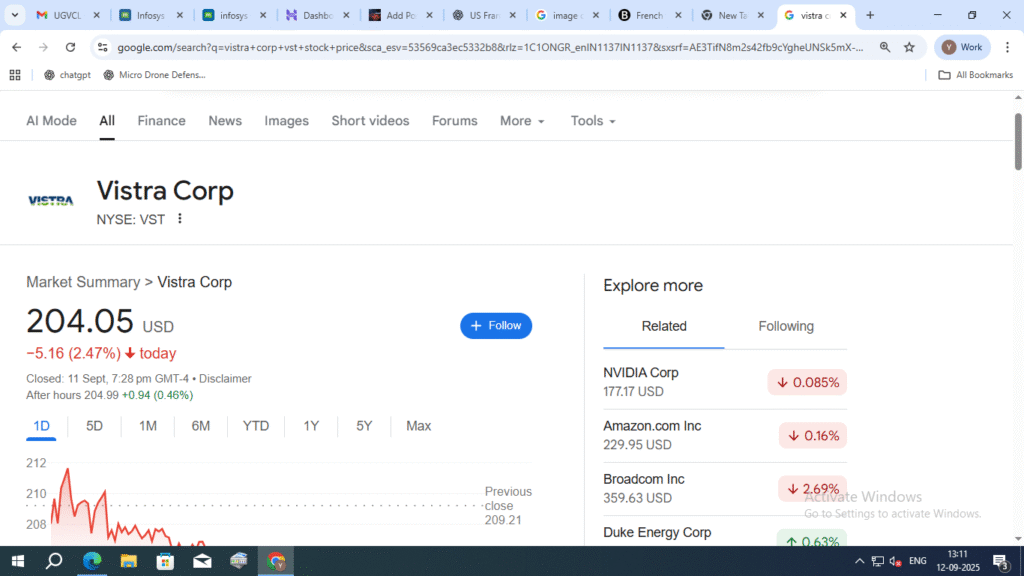

| 6 | Vistra Corporation (VST) | — (recent growth stock tied with energy / data center mix) Investors | If you believe in energy + data-center demand, entry on pullbacks or consolidation zones | Upside maybe 30-60 % from buy zone depending on growth execution | Stop if earnings / guidance falls short or energy prices shift down significantly | Opportunity: “nuclear-renaissance”, clean energy + infrastructure demand. Risks: regulatory, cost of capital, energy policy, long lead times. |

| European / French Stocks | ||||||

| 7 | Euronext (ENX-EPA) | ~ €138.80 Investing.com | Could enter around €130-140 if momentum holds; possibly on dips below. | €160-180 | ~ €110-120 | As operator of stock exchanges, infrastructure business; more stable than pure growth. Risks: regulatory, competition from technology, market volume dependency. |

| 8 | EssilorLuxottica (ESLX-EPA) | ~ €265.90 Investing.com | Entry if correction / pullback, maybe €230-260 | €320-350 | ~ €200-220 | Strong in optical / luxury eyewear; brand strength. Risks: consumer demand, cost of materials, FX, retail competition. |

| 9 | Safran (SAF-EPA) | ~ €284.60 Investing.com | Entry zone maybe €250-280 on weakness; above current if positive news / order wins. | €340-380 | ~ €200-230 | Aerospace & defense; good order backlog. Risks: geopolitical, supply chains, reliance on government contracts. |

| 10 | Air Liquide (AI-EPA) | ~ €177.30 Investing.com | Entry around €150-170 perhaps; hold if stable. | €220-250 | ~ €120-140 | Industrial gases, stable demand, diversified. Risks: energy cost, regulation, competition. |

* “Recent Price” means latest available market data (often delayed). Prices move, so zones will shift with time.

🔧 How to Use This List / Tips

- These suggested buy zones, targets, stop losses are illustrations. Adjust according to your risk tolerance, timeframe (short-term vs long-term), and your view of the sector.

- Always check the latest earnings, guidance, news (e.g. order wins, regulatory changes) before entering.

- Use technical charts to see where support and resistance are: those help you set realistic stop losses.

- Diversify: mixing high-growth companies with more stable sectors (industrial, infrastructure, energy) helps reduce risk.