Having the right insurance can mean the difference between a minor setback and a financial disaster. Whether it’s a car crash, a house fire, or a sudden hospital visit, proper coverage shields your savings and keeps life on track.

This detailed guide explains the main types of insurance in the United States, compares key features, and offers clear advice to help you choose plans that match your needs.

1. Why Coverage Matters

Life is unpredictable. A single medical emergency can cost tens of thousands of dollars, while a serious accident can bring legal claims and property damage.

An insurance policy is a contract: you pay a monthly or yearly premium, and the company promises to pay for covered losses. The right plan transfers risk away from you and toward a financially strong provider.

2. Main Types of Insurance in the U.S.

Americans can buy many different policies, but six categories dominate. Understanding each one helps you decide what protection is essential.

a. Health Insurance

Health coverage pays for doctor visits, hospital stays, surgery, and prescriptions. Because U.S. health care is expensive, health insurance is often the first plan people buy.

Key factors include the premium (monthly cost), deductible (what you pay before benefits start), and network (which doctors or hospitals are included).

Common plan types:

- HMO – Lower premiums but requires in-network care.

- PPO – More flexibility with higher cost.

- High Deductible Plan (HDHP) – Lower premium with higher out-of-pocket costs, often paired with a Health Savings Account.

b. Auto Insurance

Every state except New Hampshire requires drivers to carry auto coverage. It pays for repairs to your vehicle, damage you cause to others, and medical expenses after accidents.

Premiums depend on driving record, car type, location, and coverage levels such as liability, collision, or comprehensive.

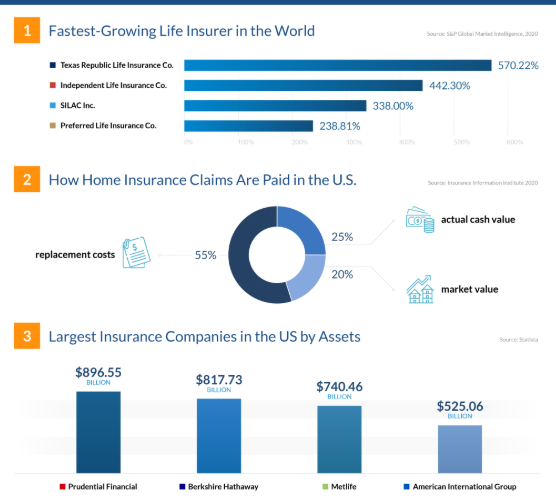

c. Life Insurance

Life coverage provides money to beneficiaries if the policyholder dies.

- Term Life – Covers a set period (10–30 years) and is affordable.

- Whole/Universal Life – Lifetime protection that can build cash value, but at a higher cost.

d. Homeowners and Renters Insurance

Homeowners plans protect your house and belongings against fire, theft, and natural disasters. They also include liability coverage if someone is injured on your property.

Renters policies give similar protection for personal property but not the building itself.

e. Disability Insurance

Disability coverage replaces part of your income if illness or injury prevents you from working.

- Short-term plans cover a few months.

- Long-term plans can last years or until retirement.

f. Long-Term Care Insurance

This policy helps pay for nursing homes, assisted living, or in-home care later in life. As people live longer, these costs are rising, making this type of insurance worth considering.

3. Quick Comparison of Average Costs*

| Type | Monthly Cost | Key Benefit | Possible Drawback |

|---|---|---|---|

| Health | $450–$600 | Protects against huge medical bills | Complex rules, rising costs |

| Auto | $120–$180 | Required by law, covers accidents | Rates rise after claims |

| Life (Term) | $25–$40 | Financial security for family | No payout if you outlive term |

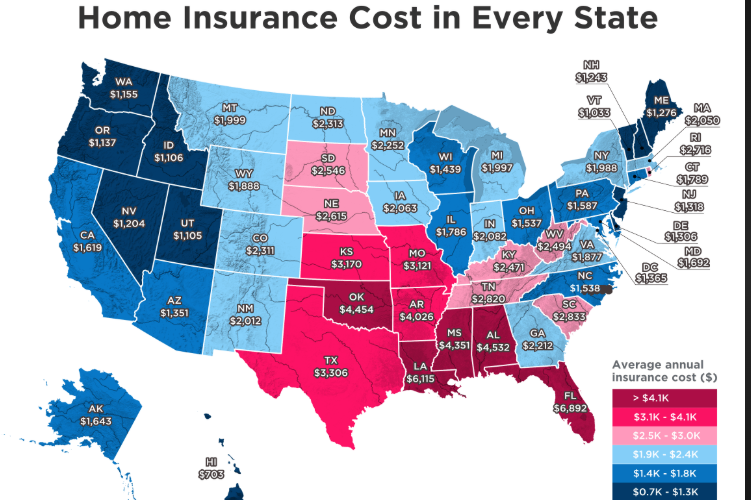

| Homeowners | $100–$150 | Covers house & belongings | Higher cost in disaster zones |

| Renters | $15–$25 | Low-cost property protection | Building not covered |

| Disability | $30–$100 | Replaces lost income | Hard to qualify for some jobs |

| Long-Term Care | $90–$200 (age 50) | Pays for elder care | Premiums can rise |

*Costs vary by state, age, and coverage level.

4. Leading U.S. Companies

Several providers consistently earn strong financial and customer-service ratings.

- Health: Blue Cross Blue Shield, Kaiser Permanente, UnitedHealthcare, Aetna

- Auto: GEICO (low rates), State Farm (agent network), Progressive (usage-based discounts), USAA (military families)

- Life: Northwestern Mutual, MassMutual, New York Life, Haven Life (fast online term policies)

- Homeowners/Renters: Amica, Erie, Nationwide, USAA

- Disability & Long-Term Care: Guardian, Mutual of Omaha, MassMutual

Always check AM Best or Moody’s ratings to confirm financial strength before buying any insurance product.

5. Key Features to Compare

Regardless of category, compare these factors before choosing a plan:

- Premium vs. Deductible – Lower monthly cost often means higher out-of-pocket expenses.

- Coverage Limits – Maximum amount the company will pay for a claim.

- Exclusions – Situations not covered (for example, flood damage may require a separate policy).

- Customer Service – Fast, fair claims handling is essential.

- Flexibility – Ability to adjust coverage, add riders, or bundle policies for discounts.

6. Which Coverage to Buy First

Priorities depend on your life stage, but most Americans follow this order:

- Health Insurance – Essential for everyone.

- Auto Insurance – Mandatory if you drive.

- Homeowners or Renters Insurance – Protects property and belongings.

- Life Insurance – Important if you have dependents or debts.

- Disability Insurance – Safeguards income.

- Long-Term Care Insurance – Consider as you age.

7. Practical Scenarios

- Young Single Adult: Health, auto (if driving), and renters coverage are key. Life coverage can wait unless you have co-signed debts.

- Married with Kids: Health, auto, homeowners, and life policies become top priorities. Disability protection adds extra security.

- Retiree: Health (Medicare plus supplement) and homeowners coverage remain vital. Long-term care insurance may help protect savings.

8. Tips for Choosing the Best Plan

- Assess Your Needs – Identify risks you cannot afford to cover yourself.

- Set a Budget – Balance premiums with deductibles.

- Get Multiple Quotes – Compare at least three companies for each type of insurance.

- Check Financial Ratings – Pick a provider with strong reserves to pay claims.

- Review Annually – Life changes—marriage, children, new home—mean your coverage may need updates.

9. Recommended Picks

- Best Health Plan: Blue Cross Blue Shield or UnitedHealthcare for nationwide networks.

- Best Auto Rates: GEICO or Progressive for competitive pricing.

- Best Life Policy for Families: A 20- or 30-year term life plan from Haven Life, MassMutual, or Northwestern Mutual.

- Best Homeowners Coverage: Amica or USAA (especially for military families).

🔗 Top Platforms to Buy Insurance Online

| Platform | Type of Insurance | Why It’s Easy | Direct Link |

|---|---|---|---|

| Policygenius | Life, Health, Home, Auto, Renters | Simple questionnaire, instant quotes from top insurers | Visit Policygenius |

| Insurify | Auto, Home, Renters | AI-based comparison, fast checkout | Visit Insurify |

| HealthCare.gov | Health (ACA plans) | Government marketplace, subsidies for eligible buyers | Visit HealthCare.gov |

| Lemonade | Renters, Home, Pet, Life | App-based, super quick signup (as fast as 90 seconds) | Visit Lemonade |

| Progressive | Auto, Home, Bundled | “Name Your Price” tool to fit your budget | Visit Progressive |

| Esurance (Allstate) | Auto, Home | Transparent pricing and easy digital claims | Visit Esurance |

| Zander Insurance | Life, Identity Theft | Good for term life & ID theft protection | Visit Zander |

✅ Step-by-Step to Buy Insurance Online Easily

- Choose a Platform – Click any of the links above.

- Enter Details – Fill in basic info (age, ZIP code, coverage need).

- Compare Quotes – View side-by-side offers.

- Customize Coverage – Adjust deductibles and policy limits.

- Purchase Securely – Pay online and get an instant policy document.

Best Insurance Comparison and Buying Guide in the USA (2025)

Choosing the right insurance in the USA can feel overwhelming. However, understanding the main categories and comparing leading providers will help you secure affordable and reliable protection. Below you will find a simple guide with direct buying links, smooth transitions, and short sentences for easy reading.

Key Types of that

First, think about the coverage you need. Health insurance protects you from high medical costs. Auto insurance keeps your car and finances safe after accidents. Home insurance guards your property against fire, theft, or storms. In addition, life insurance offers financial security for your loved ones. Because every person has unique needs, compare more than one type before you buy.

Top Insurance Platforms and Easy Links

Fortunately, several trusted websites make it simple to compare and purchase policies online:

- Policygenius – Compare life, health, home, and auto insurance with clear side-by-side quotes.

- Insurify – Get quick auto, home, or renters insurance estimates using smart AI tools.

- HealthCare.gov – Find health insurance plans that qualify for government subsidies.

- Lemonade – Buy renters, home, or pet insurance with an app in under two minutes.

- Progressive – Bundle auto and home insurance to save money.

- Esurance – Enjoy transparent pricing and easy digital claims.

Each platform offers a step-by-step process. First, enter your details. Next, review multiple quotes. Then, adjust deductibles or coverage levels. Finally, purchase the plan and receive your policy online.

Tips for a Smooth Purchase

To begin, compare at least three quotes. Additionally, read customer reviews to check service quality. If possible, bundle home and auto insurance to reduce premiums. As a final step, confirm that your chosen plan fits both your budget and lifestyle.

Conclusion

In summary, buying that in the USA no longer requires long phone calls or office visits. With tools like Policygenius or Lemonade, you can compare prices, customize coverage, and purchase a policy in minutes. Because everyone’s needs differ, review your goals carefully before you decide. A clear comparison now can save you money and stress later.

Pingback: news US Latest on Trump Government 2025: Really Happening