12 Positive Intraday Stocks to Watch in the US Market Today

🇺🇸 12 Positive Intraday Stocks to Watch in the US Market Today: Buy–Sell Targets, Stop-Loss & Volume Analysis

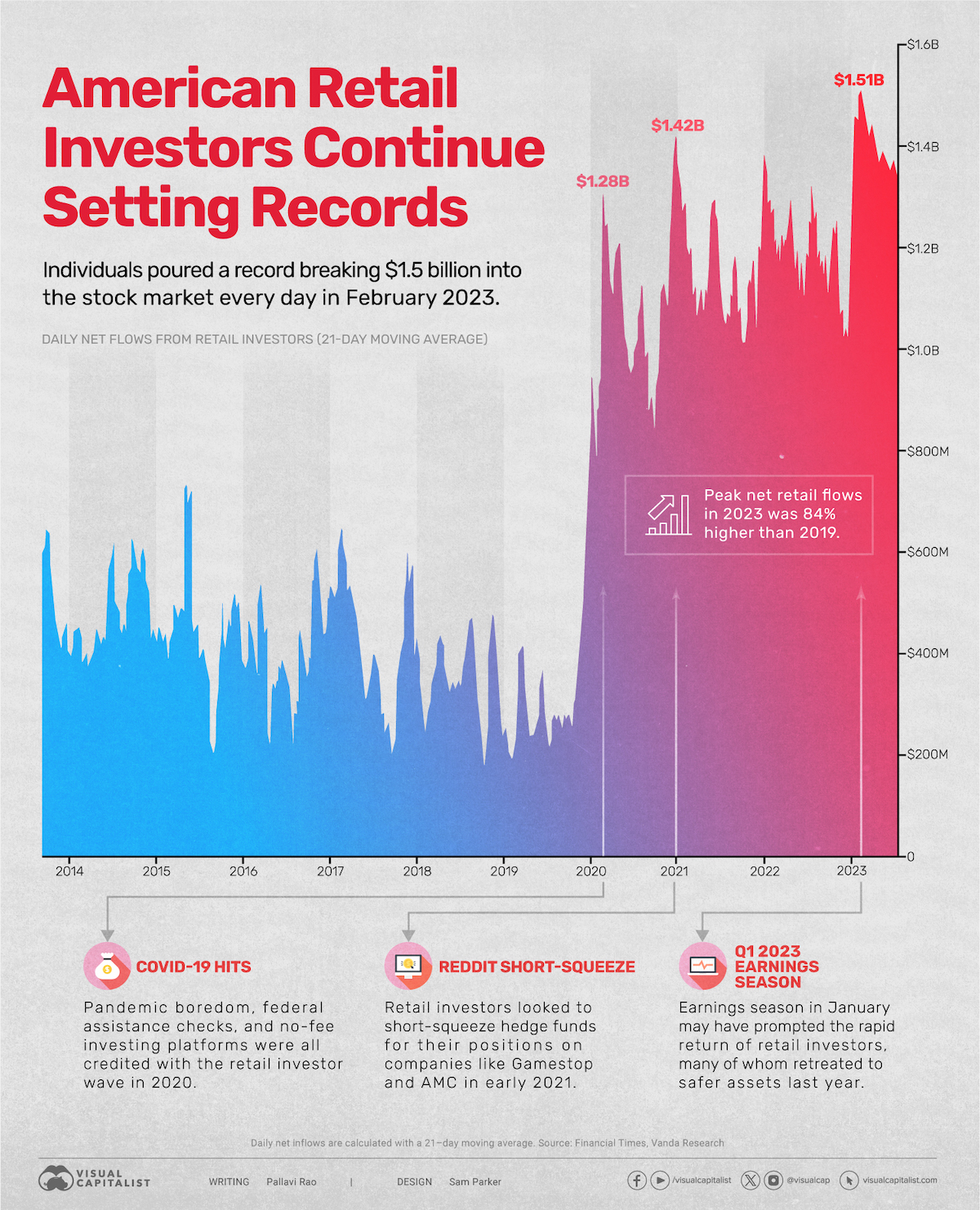

Intraday trading in the US stock market remains highly attractive due to deep liquidity, global participation, strong institutional volume, and sharp price movements. With indices like the Dow Jones, S&P 500, and Nasdaq reacting daily to economic data, interest rates, earnings, and geopolitical news, short-term trading opportunities continue to emerge across sectors.

This article presents a US-market version of your intraday stock list, written in a fully human, SEO-friendly, news-style format, focusing on positive momentum stocks, clear buy–sell levels, targets, stop-loss, and volume strength—ideal for day traders, scalpers, and short-term market participants.

⚠️ This is educational market analysis, not investment advice. Always confirm levels with live charts.

12 Positive Intraday Stocks to Watch in the US Market Today How This US Intraday Stock List Is Structured

Each stock includes:

- Intraday Buy Zone (Price Area)

- Intraday Target

- Protective Stop-Loss

- Volume & Momentum Insight

- Why the Stock Is in Focus Today

This mirrors professional Wall Street-style intraday trading notes.

12 Positive Intraday Stocks to Watch in the US Market Today High-Volume US Intraday Stocks (Strong Momentum)

🔹 NVIDIA Corporation (NVDA)

- Buy Zone: $570–575

- Intraday Target: $590

- Stop-Loss: $558

- Volume Strength: Very High

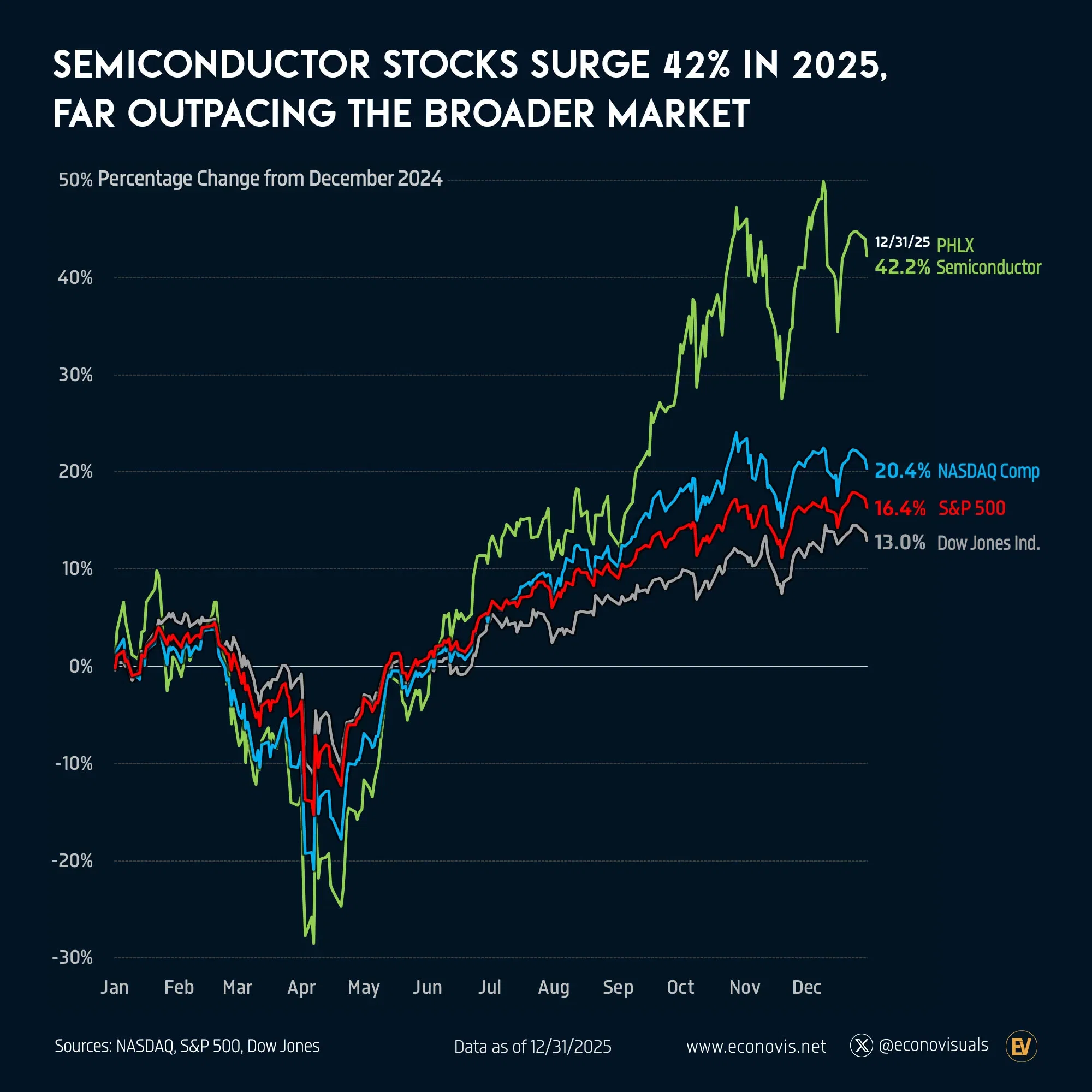

NVIDIA remains one of the most actively traded US stocks, driven by AI demand, data center spending, and semiconductor momentum. Strong pre-market activity and consistent institutional buying make NVDA a top intraday candidate, especially during the first two hours of the session.

Intraday Bias: Bullish above $570

🔹 Apple Inc. (AAPL)

- Buy Zone: $188–190

- Target: $195

- Stop-Loss: $184

- Volume: High

Apple often provides stable intraday trends, ideal for traders who prefer lower volatility but consistent price movement. AAPL typically reacts well to Nasdaq sentiment and bond yield movements.

🔹 Tesla Inc. (TSLA)

- Buy Zone: $235–238

- Target: $248

- Stop-Loss: $228

- Volume: Very High

Tesla is a favorite among intraday traders due to its wide daily range. Momentum traders can capitalize on breakout or breakdown setups, especially when volume expands after the US market open.

12 Positive Intraday Stocks to Watch in the US Market Today Technology & AI-Focused Intraday Opportunities

🔹 Microsoft Corporation (MSFT)

- Buy Zone: $408–412

- Target: $420

- Stop-Loss: $398

Microsoft benefits from AI integration, cloud growth, and enterprise demand, offering clean intraday chart structures suitable for disciplined trading.

🔹 Advanced Micro Devices (AMD)

- Buy Zone: $162–165

- Target: $172

- Stop-Loss: $158

AMD frequently mirrors NVDA’s intraday direction and is ideal for momentum-based tech trades.

12 Positive Intraday Stocks to Watch in the US Market Today Banking & Financial Stocks (US Market Leaders)

🔹 JPMorgan Chase & Co. (JPM)

- Buy Zone: $168–170

- Target: $176

- Stop-Loss: $164

- Volume: High

Banking stocks respond sharply to US bond yields, Fed commentary, and inflation data. JPM remains a preferred intraday stock due to its liquidity and institutional participation.

🔹 Bank of America (BAC)

- Buy Zone: $33.80–34.10

- Target: $35.20

- Stop-Loss: $33.20

BAC offers smooth intraday ranges, suitable for scalpers and conservative traders.

🛢️ Energy & Commodity-Linked US Stocks

🔹 Exxon Mobil (XOM)

- Buy Zone: $102–104

- Target: $107

- Stop-Loss: $100

Energy stocks like Exxon move in sync with crude oil prices and geopolitical news, making them attractive for news-based intraday trades.

🔹 Chevron Corporation (CVX)

- Buy Zone: $150–152

- Target: $156

- Stop-Loss: $147

Chevron often follows a trend-based intraday structure, ideal when oil futures show direction.

🛍️ Consumer, Retail & Lifestyle Stocks

🔹 Amazon.com Inc. (AMZN)

- Buy Zone: $168–170

- Target: $176

- Stop-Loss: $164

Amazon remains a high-liquidity intraday stock, reacting strongly to Nasdaq moves and consumer sentiment.

🔹 Walmart Inc. (WMT)

- Buy Zone: $156–158

- Target: $162

- Stop-Loss: $153

Walmart offers defensive intraday opportunities, especially during volatile market sessions.

🏭 Industrial & Infrastructure Plays

🔹 Boeing Co. (BA)

- Buy Zone: $208–210

- Target: $218

- Stop-Loss: $202

- Volume: High

Boeing shows sharp intraday reactions to news flow, aircraft orders, and defense-related updates.

🔹 Caterpillar Inc. (CAT)

- Buy Zone: $292–295

- Target: $305

- Stop-Loss: $285

Caterpillar benefits from infrastructure spending themes and often trends well intraday.

📊 Intraday Trading Strategy for the US Market

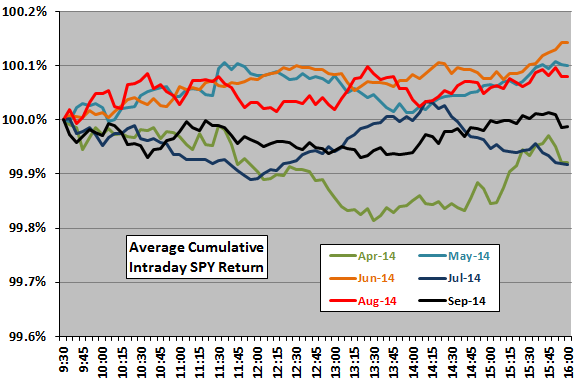

✅ Best Trading Hours

- 9:30–11:30 AM EST: Highest volume & volatility

- 2:30–4:00 PM EST: Trend continuation or reversal

✅ Risk Management Rules

- Risk only 0.5–1% of capital per trade

- Always use hard stop-loss

- Avoid overtrading during low-volume midday hours

- Exit all intraday positions before market close

🌍 Key Factors Influencing US Intraday Stocks Today

- Federal Reserve interest rate outlook

- US inflation & jobs data

- Nasdaq futures direction

- Crude oil & dollar index movement

- Earnings announcements

Understanding these drivers improves intraday accuracy and confidence.

⚠️ Important Risk Disclosure

This US intraday stock list is provided for educational and informational purposes only. Stock prices can move unpredictably due to news, economic data, or global events. Past performance does not guarantee future results. Consider consulting a licensed US financial advisor before trading.

🧠 Final US Market Outlook (Positive Bias)

The current US market environment favors:

- High-volume technology leaders (NVIDIA, Apple, Microsoft)

- Momentum-driven stocks (Tesla, AMD)

- Defensive large caps (Walmart, JPMorgan)

- Energy & industrial plays (Exxon, Caterpillar)

These stocks offer liquidity, volatility, and institutional interest, making them suitable for intraday trading with disciplined risk control.

US Supreme Court Tariff Decision That Could Shock the Economy 5 Key Impacts

Pingback: Trump Calls Himself “Acting President of Venezuela 12

Pingback: Warriorz vs Royal Challengers Unleashed: The Explosive WPL 1