Upcoming IPO

Upcoming IPO in the UK Stock Market: What Investors Can Expect Next

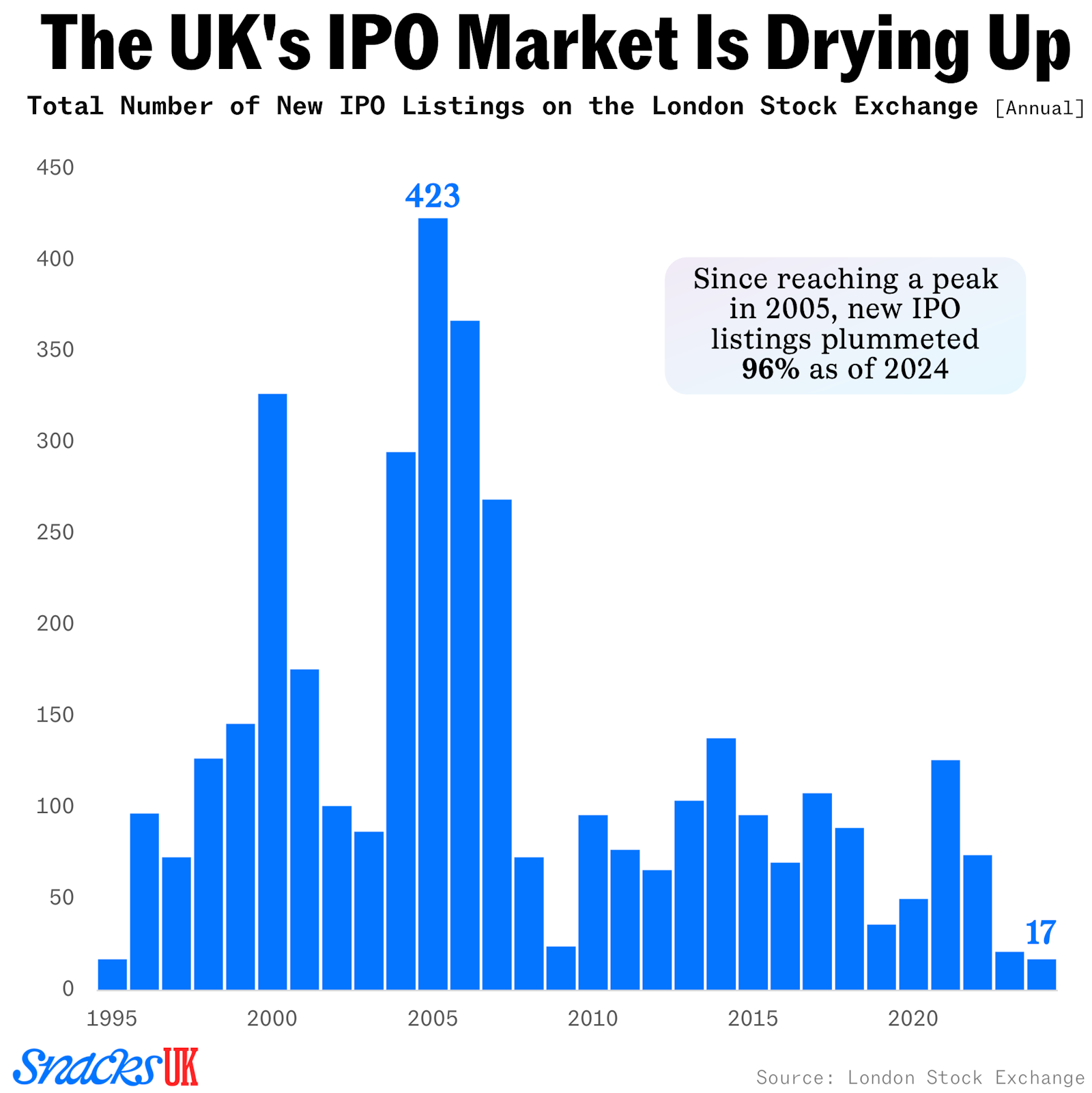

After a slow phase over the last few years, the UK IPO market is slowly showing signs of revival. Market experts believe that 2025–2026 could mark a turnaround for the London Stock Exchange (LSE) and AIM market, as several well-known private companies and fintech firms prepare for public listings.

Rising interest rates are stabilising, valuations are becoming more realistic, and private equity firms are once again looking for exits. All these factors are creating the right environment for new IPOs in the UK stock market.

Below is a human-written, easy-to-understand overview of the major upcoming IPO candidates in the UK, along with their business models and investor appeal.

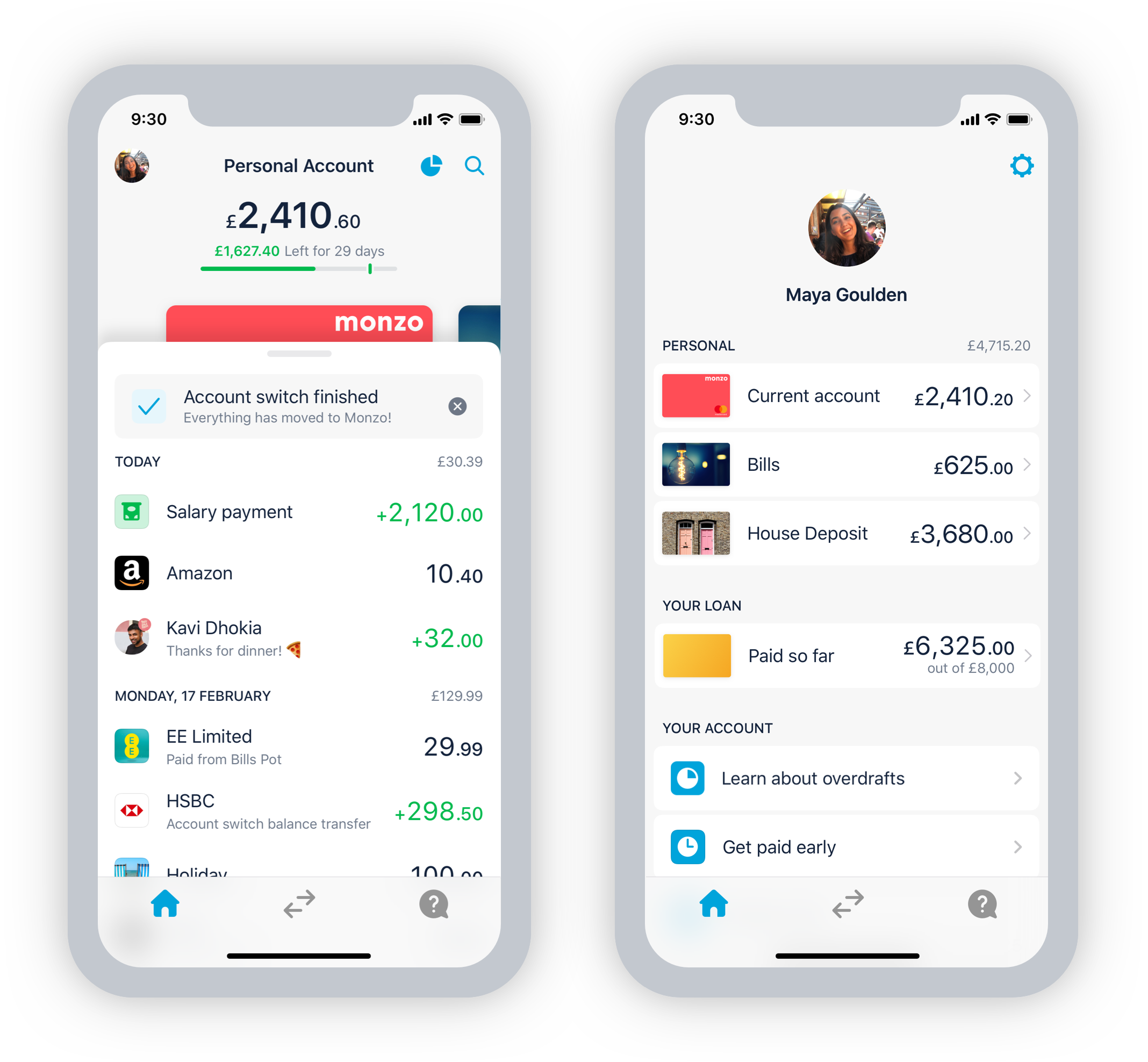

1. Upcoming IPO Monzo Bank – Digital Banking Leader

Sector: Fintech / Digital Banking

Monzo is one of the UK’s most popular challenger banks, with millions of customers using its app for daily banking, payments, budgeting, and savings. Unlike traditional banks, Monzo is fully digital and focuses heavily on customer experience.

The company has long been expected to go public, but it delayed its IPO plans to focus on profitability and regulatory stability. With improving financial performance, Monzo is again being viewed as a strong IPO candidate for the London Stock Exchange.

Why investors are watching Monzo:

- Strong brand loyalty

- Growing user base

- Fintech remains a high-growth sector

2. SumUp – Payments & Fintech Company Upcoming IPO

Sector: Payments / Financial Technology

SumUp provides card payment solutions for small businesses, freelancers, and merchants across the UK and Europe. Its easy-to-use card readers and mobile payment tools have made it popular among independent retailers.

The company has expanded beyond payments into invoicing and business accounts, making it a full-service fintech platform. Market reports suggest SumUp could choose London as its IPO destination when market conditions improve.

Investor appeal:

- Recurring transaction revenue

- Exposure to SME growth

- Strong European presence

3. Shawbrook Group – Specialist UK Lender Upcoming IPO

Sector: Financial Services / Banking

Shawbrook is a UK-focused lender that provides loans to small businesses, property investors, and consumers. It is backed by private equity and has previously been listed on the stock exchange.

With interest in banking stocks returning, Shawbrook is reportedly considering a return to public markets through a London IPO. If listed, it would add strength to the UK’s financial services segment.

Why it matters:

- Stable lending business

- Rising demand for SME finance

- Private-equity backed IPOs often attract institutions

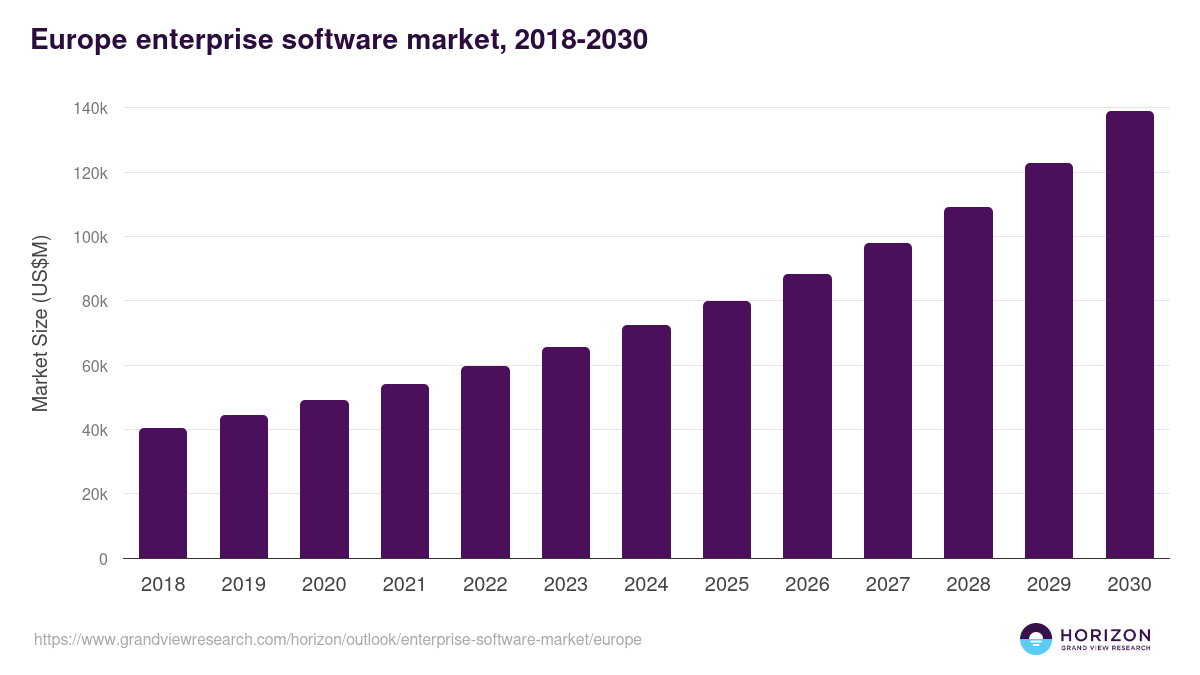

4. Visma – Enterprise Software Company Upcoming IPO

Sector: Software / SaaS

Visma is a large European software company providing cloud-based accounting, payroll, and business tools. Though headquartered outside the UK, Visma has shown interest in a London listing.

A Visma IPO would be a major boost for the UK tech market and could become one of the largest tech listings in London in recent years.

Why investors care:

- Predictable subscription revenue

- Enterprise software demand

- International business exposure

5. Octopus Energy (or Kraken Platform)

Sector: Renewable Energy / Energy Technology

Octopus Energy is one of the UK’s fastest-growing green energy companies. Its technology platform, Kraken, manages energy systems and customer accounts globally.

While there has been debate about whether the company will list in the UK or the US, it remains a key IPO candidate if London market conditions become more attractive.

Why this IPO is important:

- Strong focus on clean energy

- Government support for renewables

- Global expansion potential

6. Other UK IPO Candidates to Watch

Several other companies are also being discussed in the UK IPO space, depending on market conditions:

- LoveHolidays – Online travel booking platform

- CFC Underwriting – Insurance and risk management

- Howden Group – Insurance brokerage

- Consumer and retail brands backed by private equity

These companies are waiting for the right valuation and investor sentiment before making final decisions.

Why the UK IPO Market Is Gaining Momentum Again

The UK IPO market faced challenges due to:

- Global economic uncertainty

- Competition from US stock exchanges

- Lower tech valuations

However, things are improving because:

- Interest rates are stabilising

- Investors are returning to value stocks

- Government reforms aim to make London listings more attractive

Experts believe 2026 could be a recovery year for UK IPOs, especially in fintech, financial services, software, and energy.

Final Thoughts for Investors

UK IPOs may not offer instant listing gains, but they can provide long-term investment opportunities when backed by strong fundamentals. Investors should always study:

- Business profitability

- Debt levels

- Competitive advantage

- Valuation at IPO

A selective approach is key.