IPO that can help you in grow your investment

IPO that can help you in

The effect of IPO in the indian market

1. Tata Capital IPO (Mega Issue)

- Price Band: ₹310 – ₹326 per share

- Issue Size: ₹15,500 crore (largest NBFC IPO in India’s history)

- IPO Dates: October 6 – 8, 2025

- GMP (Grey Market Premium): Market is expecting a strong premium; unofficial GMP yet to stabilize.

- Allotment Status: To be checked via Link Intime allotment portal after issue closure.

Why it matters? Tata Group IPOs have a history of strong performance. With Tata Technologies’ blockbuster debut still fresh, Tata Capital is likely to attract massive subscription.

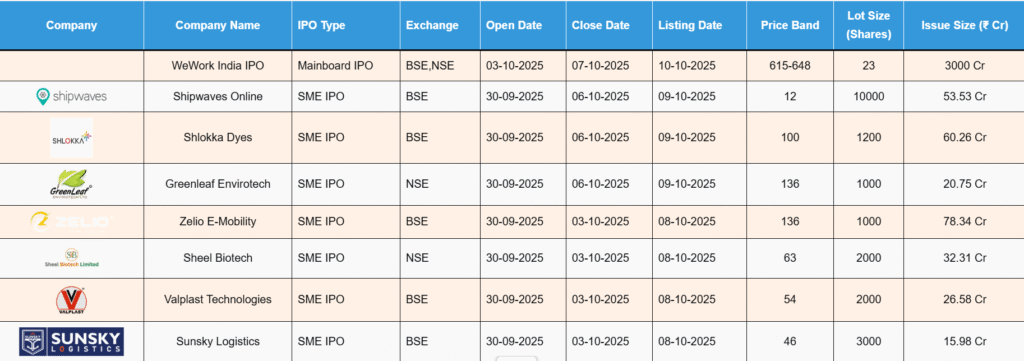

2. WeWork India IPO

- Price Band: ₹615 – ₹648 per share

- Issue Size: ₹9,796 crore

- IPO Dates: October 3 – 5, 2025

- GMP: Not clearly reported yet; cautious outlook due to global WeWork bankruptcy.

- Allotment Status: Available on BSE IPO Allotment page.

Why it matters? India’s coworking space market is booming. With startups and corporates preferring flexible offices, WeWork India could see long-term growth, though listing sentiment may be mixed.

3. Fabtech Technologies IPO

- Price Band: ₹181 – ₹191 per share

- IPO Dates: Currently open (late September – early October 2025)

- GMP: Trading modestly in the grey market, suggesting stable but not overhyped demand.

- Allotment Link: Investors can check status on KFinTech Allotment Page.

Why it matters? Fabtech provides industrial engineering solutions and could benefit from India’s manufacturing push. GMP suggests moderate listing gains, but fundamentals look solid.

4. Suba Hotels IPO

- Price Band: ₹105 – ₹111 per share

- IPO Dates: Last week of September 2025 – early October 2025

- GMP: Reports suggest a modest premium, indicating fair demand.

- Allotment Status: October 3, 2025, via registrar portal.

Why it matters? With tourism and hospitality bouncing back post-pandemic, Suba Hotels could ride the demand wave. Backing from ace investors like Ashish Kacholia is another confidence booster.

5. Pace Digitek IPO

- Price Band: ₹208 – ₹219 per share

- IPO Dates: September 27 – 30, 2025

- GMP: ~9% premium in grey market.

- Allotment Date: October 1, 2025.

- Allotment Status: Check via KFinTech IPO Status.

Why it matters? Pace Digitek focuses on IT & digital services, a sector with huge growth prospects. GMP shows moderate listing gains are expected.

📝 How to Check IPO Allotment Status

IPO allotments can be checked in multiple ways:

- Registrar Website – IPOs are usually managed by Link Intime or KFinTech. They provide allotment portals where you can enter PAN, DP ID, or Application Number.

- Stock Exchanges – Both NSE and BSE provide allotment details.

- Broker/Bank Apps – Zerodha, Groww, ICICI Direct, SBI, and others show IPO status directly in their ASBA application dashboard.

📈 Grey Market Premium (GMP) – How Reliable Is It?

The Grey Market Premium is an unofficial price at which IPO shares are traded before listing. It gives an early idea of demand, but it’s not regulated and not always accurate.

For example:

- High GMP (50%+) → Suggests strong demand, likely listing gains.

- Low/Negative GMP → Indicates weak demand; may list at or below issue price.

👉 Use GMP only as a sentiment indicator. Always check company fundamentals before applying.

🏆 Key Takeaways for IPO Investors in 2025

- Tata Capital IPO is expected to be the blockbuster of the year.

- WeWork India IPO is high-risk, high-reward due to global baggage but strong Indian market potential.

- Suba Hotels IPO and Fabtech IPO are good mid-cap plays with steady demand.

- Pace Digitek IPO is attracting digital-savvy investors looking for moderate gains.

Pro Tip: Always apply via ASBA (bank/broker apps) to ensure safety of funds and easy refunds.

🔗 Related Links (Internal + External for SEO)

- Internal (if you have finance content on your site):

- External:

Pingback: IPOs upcoming in 2025 and 2026 chance to grow capital effect

Pingback: universalcheack USA–France Relations: The Latest News,

Pingback: U.S relation ship with India is now in dangerous the

Pingback: Sports Latest News: India Shines in Cricket, Athletics,Ches