Latest News & Developments in the French Stock Market /Economy

- Sovereign Debt Rating Downgrades & Fiscal Risk

- France was downgraded by Morningstar DBRS from AA (high) to AA (stable trend). Financial Times

- The downgrade follows a similar move by Fitch. Concerns are over political instability and doubts about meeting fiscal targets. Financial Times+1

- France’s budget deficit is large (among the highest in the Eurozone), and while there’s a target (~5.4% of GDP), many analysts see risk of slippage. OECD+2Financial Times+2

- Economic Growth & Inflation Outlook

- Growth is modest. Bank of France projects ~0.7% GDP growth in 2025. Slightly higher than earlier, but still weak. Reuters

- For 2026-2027, growth is forecast to be ~0.9% to 1.1%. These are relatively low numbers compared to past norms. Reuters+2OECD+2

- Inflation is expected to remain under control: ~1.0% in 2025, rising modestly to ~1.3% in 2026, ~1.8% in 2027. Reuters+1

- Political Instability

- Prime Minister François Bayrou lost a no-confidence vote over his deficit-reduction plan, which has increased uncertainty. Reuters+1

- As of now, there is no stable majority in parliament, which makes passing fiscal reforms harder and increases risk of policy delays. Financial Times+1

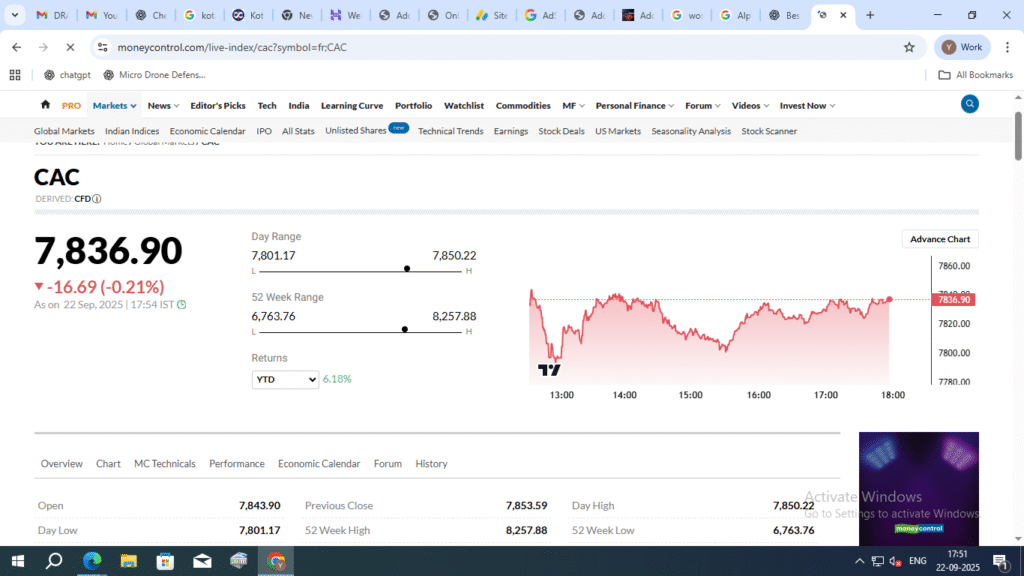

- Investor Sentiment & Market Performance

- French stocks (CAC 40) have underperformed many European peers this year. Some sectors (luxury especially) have dragged performance. Reuters+3LFDE – La Financière de l’Echiquier+3Ministry of Foreign Affairs of Estonia+3

- However, there are pockets of strength: smaller companies and innovation / biotech have seen strong gains. E.g., CAC Small index is up significantly, with some individual biotech companies more than doubling. LFDE – La Financière de l’Echiquier

- Bond Yields, Interest Rates, and Debt Costs

- French 10-year government bond yields have risen, reflecting increased concern about fiscal risk. The spread over German bunds has widened. Financial Times+1

- The Banque de France notes that political instability is dampening business and consumer confidence, which could restrain investment. Reuters

- Policy & Structural Factors

- The French government had proposed fiscal packages and reforms (for reducing deficits, etc.), but many have been rejected or delayed due to political opposition. Financial Times+1

- Private markets (private equity, private credit, etc.) are gaining interest. There is a trend toward making such investments more accessible (retail-oriented products), and French institutions are increasingly allocating to private markets as a way to hedge public market risk. State Street

- Outlook / Risks

- Downside risks: further political instability; fiscal slippage; rising energy / oil prices; stronger euro hurting exports; possible external shocks (trade, geopolitical). Reuters+1

- Possible upside: if inflation remains low, if political clarity improves, if consumer confidence returns, domestic demand could pick up. Also, excess savings may help (French households have saved a lot in recent years) which could support consumption in recovery. LFDE – La Financière de l’Echiquier+1

- Recent Market Moves

- CAC 40 has had some recent gains. For instance, it rose ~0.6% in one session as investors digested policy announcements. Trading Economics+1

- Euronext has made adjustments in the CAC 40 ESG index; one company (Teleperformance) was excluded in the recent quarterly review effective mid-September. Euronext

🔍 What This Means for Investors

- The French market is in a phase of cautious optimism mixed with risk. Because of the political uncertainty, many investors are waiting before making large commitments.

- Sectors likely to do better: those less sensitive to consumer confidence / political risks (e.g. utilities, healthcare, perhaps tech/innovation if valuations are reasonable), smaller-caps, companies with strong export exposure (if currency and trade conditions are favorable).

- Risk management is important: because bond yields are rising, cost of capital is up; if fiscal discipline is questioned, borrowing costs can spike further. Also, external factors (global trade tensions, energy prices) may hit France hard.

- Regulatory / policy reforms may become important drivers: any successful reform of public finances, clearer government, more stability could improve sentiment strongly. Conversely, failure to pass needed measures could lead to further downgrades, higher yields, weaker stocks.

Aktuelle News zum französischen Markt

France’s debt downgraded by second rating agency within a week

France joins Eurozone’s ‘periphery’ as turmoil deepens, say investors

French central bank sees growth outlook clouded by politics

🇫🇷 Dernières nouvelles et développements – Marché boursier français / Économie

1. Abaissement de la note souveraine et risque budgétaire

- Morningstar DBRS a abaissé la note de la France de AA (high) à AA avec perspective stable. (FT)

- Fitch avait déjà dégradé la note auparavant. Les agences soulignent l’instabilité politique et les doutes sur la capacité du pays à réduire son déficit.

- Le déficit budgétaire reste élevé (parmi les plus importants de la zone euro), avec un objectif autour de 5,4 % du PIB, jugé difficile à atteindre. (OCDE)

2. Croissance et inflation

- Banque de France : prévision de croissance du PIB d’environ 0,7 % en 2025, puis entre 0,9 % et 1,1 % en 2026-2027. (Reuters)

- Inflation attendue modérée : environ 1,0 % en 2025, 1,3 % en 2026, 1,8 % en 2027. (Reuters)

3. Instabilité politique

- Le Premier ministre François Bayrou a perdu un vote de défiance concernant son plan de réduction du déficit, augmentant l’incertitude. (Reuters)

- Absence de majorité claire à l’Assemblée, ce qui complique l’adoption des réformes budgétaires. (FT)

4. Sentiment des investisseurs et performance du marché

- L’indice CAC 40 sous-performe d’autres marchés européens cette année, notamment à cause du secteur du luxe. (LFDE)

- Mais certaines petites capitalisations et sociétés innovantes (biotech) enregistrent de fortes hausses, avec des biotechs qui ont plus que doublé.

5. Taux d’intérêt et coût de la dette

- Les rendements des obligations françaises à 10 ans augmentent, reflétant les inquiétudes budgétaires. L’écart avec les Bunds allemands s’élargit. (FT)

- La Banque de France note que l’instabilité politique pèse sur la confiance des entreprises et des ménages.

6. Réformes et facteurs structurels

- Plusieurs réformes fiscales et plans budgétaires proposés par le gouvernement sont bloqués ou retardés.

- Les marchés privés (private equity, private credit) suscitent un intérêt croissant, avec des produits d’investissement plus accessibles aux particuliers. (StateStreet)

7. Perspectives et risques

- Risques : instabilité politique prolongée, dérapage budgétaire, hausse des prix de l’énergie, euro fort, tensions géopolitiques.

- Facteurs positifs potentiels : inflation faible, clarification politique, excédent d’épargne des ménages pouvant soutenir la consommation.

8. Mouvements récents du marché

- Le CAC 40 a récemment progressé d’environ 0,6 % lors d’une séance après des annonces politiques. (TradingEconomics)

- Euronext a modifié la composition de l’indice CAC 40 ESG, excluant Teleperformance lors de la révision trimestrielle de septembre. (Euronext)

🔍 Ce que cela signifie pour les investisseurs

- Le marché français traverse une phase de prudence : incertitudes politiques et budgétaires, mais opportunités sélectives.

- Secteurs résilients : santé, services publics, innovation/tech, petites valeurs exportatrices.

- La gestion du risque reste essentielle : hausse des taux, coût du capital, possibilité de nouvelles dégradations de la note de crédit.

- Toute amélioration de la stabilité politique ou des finances publiques pourrait relancer la confiance et attirer des flux d’investissement.