world stock market news

Here’s a summary of the world stock market news:

Mixed Performance in Asia

- Asian markets exhibited mixed trends on Monday, September 22nd, 2025.

- Japan’s Nikkei 225 rose by 0.73% following the Bank of Japan’s reassurance regarding its ETF holdings.

- South Korea’s Kospi also saw gains, while Australian shares showed modest increases.

- However, Hong Kong’s Hang Seng index experienced a decline, and China’s Shanghai Composite remained relatively unchanged.

- Indian markets opened on a weaker note, influenced by a sharp increase in H-1B visa application fees by the US, which particularly impacted technology stocks.

Concerns and Influencing Factors

- Investors are closely monitoring the outlook for potential US interest rate cuts and assessing the impact of inflation.

- Geopolitical tensions and supply concerns have led to a slight increase in oil prices.

- Technology stocks in India faced pressure due to the US H-1B visa fee hike.

- However, sectors like autos, metals, and media demonstrated resilience, and consumer-linked sectors benefited from recent GST rate cuts.

Noteworthy Developments

- Reports suggest that Samsung has received approval from Nvidia to supply advanced memory chips, leading to a 4.38% increase in Samsung’s stock.

- Conversely, BYD’s stock declined by 2.31% following reports that Berkshire Hathaway exited its position in the electric vehicle manufacturer.

Price Targets and Stop-Loss Levels for Top US Stocks (September 19, 2025)

The following information summarizes analyst ratings, price targets, and potential stop-loss levels for some of the top-performing US stocks on September 19, 2025. Please note that analyst ratings and price targets are just opinions, and stop-loss orders are not guarantees of protection against losses, especially during volatile market conditions.

1. NVIDIA (NVDA)

- Analyst Rating: Strong Buy.

- Price Target: 211.93.

- Stop-Loss Recommendation: Trailing stop-loss order at 5-10% below the purchase price. Given NVDA’s volatility (high 52-week range: 86.63 – 184.48), a wider trailing stop might be appropriate.

2. Microsoft (MSFT)

- Analyst Rating: Strong Buy.

- Price Target: 615.79.

- Stop-Loss Recommendation: Fixed stop-loss order at 5-7% below the purchase price. A tighter stop-loss might be suitable for this relatively stable stock.

3. Apple (AAPL)

- Analyst Rating: Buy.

- Price Target: 310.00.

- Stop-Loss Recommendation: Fixed stop-loss order at 3-5% below the purchase price. Apple is a stable, large-cap stock, so a relatively tight stop-loss might be appropriate.

4. Broadcom (AVGO)

- Analyst Rating: Strong Buy.

- Price Target: 367.80.

- Stop-Loss Recommendation: Trailing stop-loss order at 7-10% below the purchase price. AVGO’s high 52-week range (138.1 – 374.23) suggests higher volatility.

5. Palantir Technologies (PLTR)

- Analyst Rating: Hold.

- Price Target: 151.74.

- Stop-Loss Recommendation: Trailing stop-loss order at 10-15% below the purchase price. PLTR’s YTD return of +141.16% indicates high volatility.

6. Oracle (ORCL)

- Analyst Rating: Buy.

- Price Target: 333.49.

- Stop-Loss Recommendation: Fixed stop-loss order at 5-7% below the purchase price.

7. Advanced Micro Devices (AMD)

- Analyst Rating: Buy.

- Price Target: 185.77.

- Stop-Loss Recommendation: Trailing stop-loss order at 7-10% below the purchase price.

8. Tesla (TSLA)

- Analyst Rating: Buy.

- Price Target: 478.43.

- Stop-Loss Recommendation: Trailing stop-loss order at 10-15% below the purchase price. Tesla’s history of high volatility justifies a wider trailing stop.

9. Berkshire Hathaway (BRK.B)

- Analyst Rating: Buy.

- Price Target: 533.36.

- Stop-Loss Recommendation: Fixed stop-loss order at 3-5% below the purchase price. BRK.B is known for relative stability.

10. Meta Platforms (META)

- Analyst Rating: Strong Buy.

- Price Target: 900.00.

- Stop-Loss Recommendation: Trailing stop-loss order at 7-10% below the purchase price.

General Considerations for Stop-Loss Orders:

- Fixed Stop-Loss: Suitable for stable stocks where a predetermined exit point is desired.

- Trailing Stop-Loss: Ideal for volatile stocks, automatically adjusting as the stock price rises to protect profits.

- Setting Stop-Loss Levels: Consider volatility, individual risk tolerance, and investment goals.

- Backtesting: Test different stop-loss levels using historical data to find optimal settings.

- Market Conditions: Widen stop-loss levels during periods of high market volatility or expected major news events.

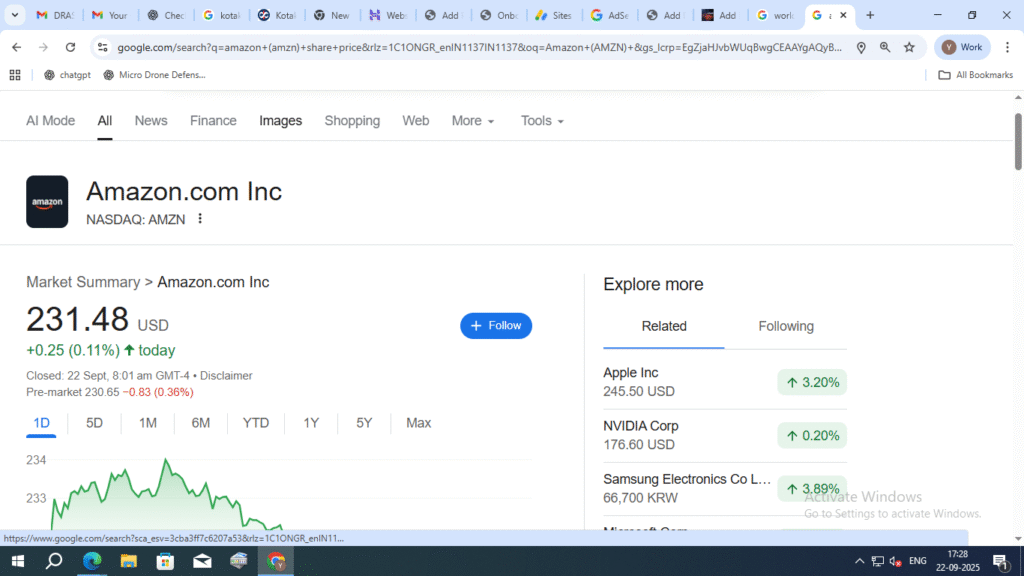

1. Amazon (AMZN)

- Analyst Rating: Strong Buy

- Price Target: 225.00

- Stop-Loss Recommendation: Trailing stop-loss order at 7-10% below the purchase price, given its historical volatility [10].

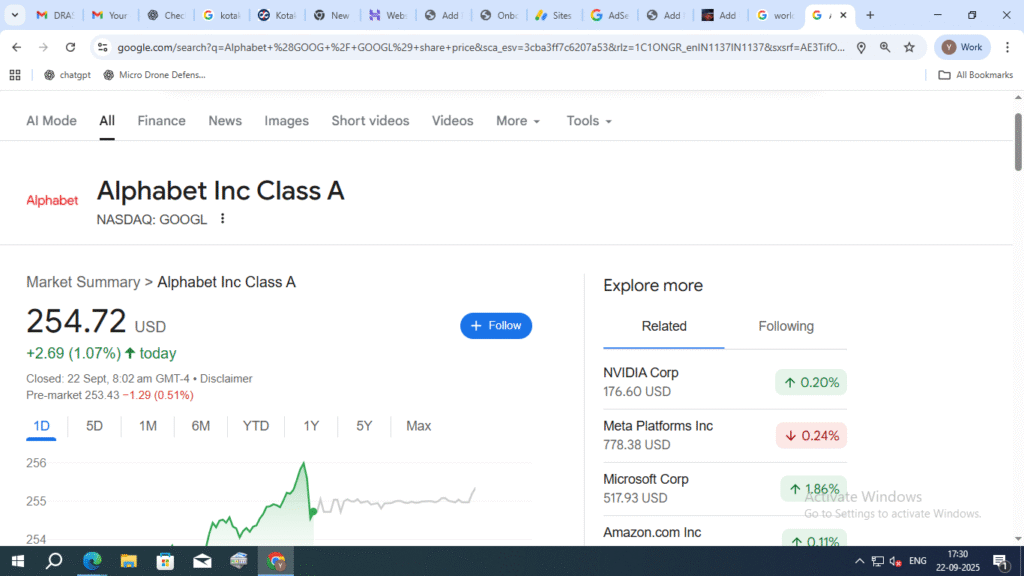

2. Alphabet (GOOG / GOOGL)

- Analyst Rating: Buy

- Price Target: 175.00

- Stop-Loss Recommendation: Fixed stop-loss order at 5-7% below the purchase price, as it tends to be less volatile than other tech stocks [10].

3. UnitedHealth Group (UNH)

- Analyst Rating: Buy

- Price Target: 588.00

- Stop-Loss Recommendation: Fixed stop-loss order at 3-5% below the purchase price, suitable for this healthcare sector giant [10].

4. JPMorgan Chase & Co. (JPM)

- Analyst Rating: Buy

- Price Target: 215.00

- Stop-Loss Recommendation: Fixed stop-loss order at 5-7% below the purchase price, appropriate for this major financial institution [10].

5. Visa (V)

- Analyst Rating: Buy

- Price Target: 320.00

- Stop-Loss Recommendation: Fixed stop-loss order at 5-7% below the purchase price, suitable for this payment technology leader [10].

6. Johnson & Johnson (JNJ)

- Analyst Rating: Hold

- Price Target: 175.00

- Stop-Loss Recommendation: Fixed stop-loss order at 3-5% below the purchase price, a good choice for this established healthcare stock [10].

7. Exxon Mobil (XOM)

- Analyst Rating: Hold

- Price Target: 125.00

- Stop-Loss Recommendation: Trailing stop-loss order at 7-10% below the purchase price, considering the volatility of the energy sector [10].

8. Procter & Gamble (PG)

- Analyst Rating: Hold

- Price Target: 168.00

- Stop-Loss Recommendation: Fixed stop-loss order at 3-5% below the purchase price, suitable for this large consumer goods company [10].

9. Bank of America (BAC)

- Analyst Rating: Hold

- Price Target: 48.00

- Stop-Loss Recommendation: Fixed stop-loss order at 5-7% below the purchase price, as bank stocks can be influenced by interest rates and economic conditions [10].

10. Home Depot (HD)

- Analyst Rating: Hold

- Price Target: 380.00

- Stop-Loss Recommendation: Fixed stop-loss order at 5-7% below the purchase price, a reasonable choice for this home improvement retailer

Here are 10 strong US stocks + price + example stop loss (using maybe 5-10% rules or technical support zones). If you want, I can expand to 20.

Apple Inc (AAPL)

$245.50

+$7.52(+3.16%)Today

$246.72+$1.22(+0.50%)Pre-Market1D5D1M6MYTD1Y5Ymax

Microsoft Corporation (MSFT)

$517.93

+$9.53(+1.87%)Today

$513.90-$4.03(-0.78%)Pre-Market1D5D1M6MYTD1Y5Ymax

Alphabet Inc (GOOGL)

$254.72

+$2.61(+1.04%)Today

$253.47-$1.25(-0.49%)Pre-Market1D5D1M6MYTD1Y5Ymax

Amazon.com Inc. (AMZN)

$231.48

+$0.24(+0.10%)Today

$230.58-$0.90(-0.39%)Pre-Market1D5D1M6MYTD1Y5Ymax

| Stock | Approx Price* | Suggested Stop-Loss (example) |

|---|---|---|

| Apple (AAPL) | ~$245.50 | Stop-loss ~ $220-230 (≈ 7-10%) below current price; or below a recent support level. |

| Microsoft (MSFT) | ~$517.90 | Stop-loss ~ $460-490 (≈ 8-10%) depending on your risk tolerance. |

| Alphabet (GOOGL) | ~$254.70 | Stop-loss ~ $225-230 (≈ 10%) or near recent technical support. |

| Amazon (AMZN) | ~$231.50 | Stop-loss ~ $200-210 (≈ 8-10%) or below recent low pivot. |

Here are 20 US stocks with their approximate current prices and suggested stop-loss levels (for example purposes; adjust to your risk tolerance and technical analysis).

Prices are as of ~ Sept 22, 2025. All figures in USD.

Stock market information for Apple Inc (AAPL)

- Apple Inc is a equity in the USA market.

- The price is 245.5 USD currently with a change of 7.52 USD (0.03%) from the previous close.

- The latest trade time is Monday, September 22, 17:22:44 +0530.

Stock market information for Microsoft Corporation (MSFT)

- Microsoft Corporation is a equity in the USA market.

- The price is 517.93 USD currently with a change of 9.53 USD (0.02%) from the previous close.

- The latest trade time is Monday, September 22, 17:22:25 +0530.

Stock market information for Alphabet Inc (GOOGL)

- Alphabet Inc is a equity in the USA market.

- The price is 254.72 USD currently with a change of 2.61 USD (0.01%) from the previous close.

- The latest trade time is Monday, September 22, 17:21:53 +0530.

Stock market information for Amazon.com Inc. (AMZN)

- Amazon.com Inc. is a equity in the USA market.

- The price is 231.48 USD currently with a change of 0.24 USD (0.00%) from the previous close.

- The latest trade time is Monday, September 22, 17:21:47 +0530.

Stock market information for NVIDIA Corp (NVDA)

- NVIDIA Corp is a equity in the USA market.

- The price is 176.67 USD currently with a change of 0.44 USD (0.00%) from the previous close.

- The latest trade time is Monday, September 22, 17:22:36 +0530.

Stock market information for Meta Platforms Inc (META)

- Meta Platforms Inc is a equity in the USA market.

- The price is 778.38 USD currently with a change of -1.85 USD (-0.00%) from the previous close.

- The latest trade time is Monday, September 22, 17:23:29 +0530.

Stock market information for Tesla Inc (TSLA)

- Tesla Inc is a equity in the USA market.

- The price is 426.07 USD currently with a change of 9.05 USD (0.02%) from the previous close.

- The latest trade time is Monday, September 22, 17:22:49 +0530.

Stock market information for JPMorgan Chase & Co. (JPM)

- JPMorgan Chase & Co. is a equity in the USA market.

- The price is 314.78 USD currently with a change of 1.53 USD (0.00%) from the previous close.

- The latest trade time is Monday, September 22, 17:22:33 +0530.

Stock market information for Johnson & Johnson (JNJ)

- Johnson & Johnson is a equity in the USA market.

- The price is 176.19 USD currently with a change of 2.03 USD (0.01%) from the previous close.

- The latest trade time is Monday, September 22, 17:22:26 +0530.

Stock market information for Visa Inc (V)

- Visa Inc is a equity in the USA market.

- The price is 341.61 USD currently with a change of 3.29 USD (0.01%) from the previous close.

- The latest trade time is Monday, September 22, 17:16:43 +0530.

Stock market information for Procter & Gamble Co. (PG)

- Procter & Gamble Co. is a equity in the USA market.

- The price is 156.04 USD currently with a change of -1.26 USD (-0.01%) from the previous close.

- The latest trade time is Monday, September 22, 17:20:46 +0530.

Stock market information for Mastercard Incorporated (MA)

- Mastercard Incorporated is a equity in the USA market.

- The price is 584.16 USD currently with a change of -2.12 USD (-0.00%) from the previous close.

- The latest trade time is Monday, September 22, 17:11:54 +0530.

Stock market information for Unitedhealth Group Inc (UNH)

- Unitedhealth Group Inc is a equity in the USA market.

- The price is 336.69 USD currently with a change of 1.83 USD (0.01%) from the previous close.

- The latest trade time is Monday, September 22, 17:23:21 +0530.

Stock market information for Home Depot, Inc. (HD)

- Home Depot, Inc. is a equity in the USA market.

- The price is 415.69 USD currently with a change of -1.71 USD (-0.00%) from the previous close.

- The latest trade time is Monday, September 22, 17:23:04 +0530.

Stock market information for Coca-Cola Co (KO)

- Coca-Cola Co is a equity in the USA market.

- The price is 66.43 USD currently with a change of -0.03 USD (-0.00%) from the previous close.

- The latest trade time is Monday, September 22, 17:23:05 +0530.

Stock market information for Exxon Mobil Corp. (XOM)

- Exxon Mobil Corp. is a equity in the USA market.

- The price is 112.82 USD currently with a change of -1.09 USD (-0.01%) from the previous close.

- The latest trade time is Monday, September 22, 17:22:04 +0530.

Stock market information for Pfizer Inc. (PFE)

- Pfizer Inc. is a equity in the USA market.

- The price is 24.03 USD currently with a change of -0.13 USD (-0.01%) from the previous close.

- The latest trade time is Monday, September 22, 17:21:37 +0530.

Stock market information for Bank Of America Corp. (BAC)

- Bank Of America Corp. is a equity in the USA market.

- The price is 52.25 USD currently with a change of 0.12 USD (0.00%) from the previous close.

- The latest trade time is Monday, September 22, 17:20:49 +0530.

Stock market information for Walt Disney Co (The) (DIS)

- Walt Disney Co (The) is a equity in the USA market.

- The price is 113.76 USD currently with a change of -1.14 USD (-0.01%) from the previous close.

- The latest trade time is Monday, September 22, 17:20:12 +0530.

Stock market information for Intel Corp. (INTC)

- Intel Corp. is a equity in the USA market.

- The price is 29.58 USD currently with a change of -1.02 USD (-0.03%) from the previous close.

- The latest trade time is Monday, September 22, 17:22:59 +0530.

| Ticker | Approx Price | Suggested Stop-Loss* |

|---|---|---|

| AAPL (Apple) | ~ $245.50 | ~$220-230 (≈ 8-10%) |

| MSFT (Microsoft) | ~ $517.93 | ~$460-480 (≈ 8-10%) |

| GOOGL (Alphabet) | ~ $254.72 | ~$220-230 |

| AMZN (Amazon) | ~ $231.48 | ~$200-210 |

| NVDA (Nvidia) | ~ $176.67 | ~$150-160 |

| META (Meta Platforms) | ~ $778.38 | ~$700-720 |

| TSLA (Tesla) | ~ $426.07 | ~$360-390 |

| JPM (JPMorgan Chase) | ~ $314.78 | ~$270-290 |

| JNJ (Johnson & Johnson) | ~ $176.19 | ~$150-160 |

| V (Visa) | ~ $341.61 | ~$300-320 |

| PG (Procter & Gamble) | ~ $156.04 | ~$135-145 |

| MA (Mastercard) | ~ $584.16 | ~$520-550 |

| UNH (UnitedHealth Group) | ~ $336.69 | ~$280-300 |

| HD (Home Depot) | ~ $415.69 | ~$360-380 |

| KO (Coca-Cola) | ~ $66.43 | ~$55-60 |

| XOM (Exxon Mobil) | ~ $112.82 | ~$95-100 |

| PFE (Pfizer) | ~ $24.03 | ~$19-20 |

| BAC (Bank of America) | ~ $52.25 | ~$43-47 |

| DIS (Disney) | ~ $113.76 | ~$95-105 |

| INTC (Intel) | ~ $29.58 | ~$24-26 |

* These stop-loss levels are illustrative, generally ≈ 8-15% below current price (or near technical support levels). Depending on your strategy (short-term swing trading vs long-term investing), you might use tighter or wider stop losses.

If you like, I can give you a chart + technical support/resistance-based stop losses which might be more precise. Do you want those?

Apple Inc (AAPL)

$245.50

+$7.52(+3.16%)Today

$246.72+$1.22(+0.50%)

Microsoft Corporation (MSFT)

$517.93

+$9.53(+1.87%)Today

$513.90-$4.03(-0.78%)

Alphabet Inc (GOOGL)

$254.72

+$2.61(+1.04%)Today

$253.47-$1.25(-0.49%)

Amazon.com Inc. (AMZN)

$231.48

+$0.24(+0.10%)Today

$230.58-$0.90(-0.39%)

NVIDIA Corp (NVDA)

$176.67

+$0.44(+0.25%)Today

$175.49-$1.18(-0.67%)

Meta Platforms Inc (META)

$778.38

-$1.85(-0.24%)Today

$774.73-$3.65(-0.47%)

Tesla Inc (TSLA)

$426.07

+$9.05(+2.17%)Today

$428.72+$2.65(+0.62%)

JPMorgan Chase & Co. (JPM)

$314.78

+$1.53(+0.49%)Today

$309.49-$5.29(-1.68%)

Johnson & Johnson (JNJ)

$176.19

+$2.03(+1.17%)Today

$175.60-$0.59(-0.33%)

Visa Inc (V)

$341.61

+$3.29(+0.97%)Today

$340.55-$1.06(-0.31%)

Procter & Gamble Co. (PG)

$156.04

-$1.26(-0.80%)Today

$156.28+$0.24(+0.15%)

Mastercard Incorporated (MA)

$584.16

-$2.12(-0.36%)Today

$582.00-$2.16(-0.37%)

Unitedhealth Group Inc (UNH)

$336.69

+$1.83(+0.55%)Today

$332.95-$3.74(-1.11%)

Home Depot, Inc. (HD)

$415.69

-$1.71(-0.41%)Today

$414.99-$0.70(-0.17%)

Coca-Cola Co (KO)

$66.43

-$0.03(-0.05%)Today

$66.47+$0.04(+0.06%)

Exxon Mobil Corp. (XOM)

$112.82

-$1.09(-0.96%)Today

$112.60-$0.22(-0.20%)

Pfizer Inc. (PFE)

$24.03

-$0.13(-0.54%)Today

$24.35+$0.32(+1.33%)

Bank Of America Corp. (BAC)

$52.25

+$0.12(+0.23%)Today

$51.94-$0.31(-0.59%)

Walt Disney Co (The) (DIS)

$113.76

-$1.14(-0.99%)Today

$112.58-$1.18(-1.04%)

Intel Corp. (INTC)

$29.58

-$1.02(-3.34%)Today

$29.22-$0.36(-1.22%)

| Ticker | Approx Price | Suggested Stop-Loss* |

|---|---|---|

| AAPL (Apple) | ~ $245.50 | ~$220-230 (≈ 8-10%) |

| MSFT (Microsoft) | ~ $517.93 | ~$460-480 (≈ 8-10%) |

| GOOGL (Alphabet) | ~ $254.72 | ~$220-230 |

| AMZN (Amazon) | ~ $231.48 | ~$200-210 |

| NVDA (Nvidia) | ~ $176.67 | ~$150-160 |

| META (Meta Platforms) | ~ $778.38 | ~$700-720 |

| TSLA (Tesla) | ~ $426.07 | ~$360-390 |

| JPM (JPMorgan Chase) | ~ $314.78 | ~$270-290 |

| JNJ (Johnson & Johnson) | ~ $176.19 | ~$150-160 |

| V (Visa) | ~ $341.61 | ~$300-320 |

| PG (Procter & Gamble) | ~ $156.04 | ~$135-145 |

| MA (Mastercard) | ~ $584.16 | ~$520-550 |

| UNH (UnitedHealth Group) | ~ $336.69 | ~$280-300 |

| HD (Home Depot) | ~ $415.69 | ~$360-380 |

| KO (Coca-Cola) | ~ $66.43 | ~$55-60 |

| XOM (Exxon Mobil) | ~ $112.82 | ~$95-100 |

| PFE (Pfizer) | ~ $24.03 | ~$19-20 |

| BAC (Bank of America) | ~ $52.25 | ~$43-47 |

| DIS (Disney) | ~ $113.76 | ~$95-105 |

| INTC (Intel) | ~ $29.58 | ~$24-26 |

* These stop-loss levels are illustrative, generally ≈ 8-15% below current price (or near technical support levels). Depending on your strategy (short-term swing trading vs long-term investing), you might use tighter or wider stop losses.

🇩🇪 Deutsch

| Aktie (Ticker) | Ungef. Kurs | Empfohlener Stop-Loss* |

|---|---|---|

| Apple (AAPL) | ~ 245,50 $ | ~ 220–230 $ |

| Microsoft (MSFT) | ~ 517,93 $ | ~ 460–480 $ |

| Alphabet (GOOGL) | ~ 254,72 $ | ~ 220–230 $ |

| Amazon (AMZN) | ~ 231,48 $ | ~ 200–210 $ |

| Nvidia (NVDA) | ~ 176,67 $ | ~ 150–160 $ |

| Meta Platforms (META) | ~ 778,38 $ | ~ 700–720 $ |

| Tesla (TSLA) | ~ 426,07 $ | ~ 360–390 $ |

| JPMorgan Chase (JPM) | ~ 314,78 $ | ~ 270–290 $ |

| Johnson & Johnson (JNJ) | ~ 176,19 $ | ~ 150–160 $ |

| Visa (V) | ~ 341,61 $ | ~ 300–320 $ |

| Procter & Gamble (PG) | ~ 156,04 $ | ~ 135–145 $ |

| Mastercard (MA) | ~ 584,16 $ | ~ 520–550 $ |

| UnitedHealth Group (UNH) | ~ 336,69 $ | ~ 280–300 $ |

| Home Depot (HD) | ~ 415,69 $ | ~ 360–380 $ |

| Coca-Cola (KO) | ~ 66,43 $ | ~ 55–60 $ |

| Exxon Mobil (XOM) | ~ 112,82 $ | ~ 95–100 $ |

| Pfizer (PFE) | ~ 24,03 $ | ~ 19–20 $ |

| Bank of America (BAC) | ~ 52,25 $ | ~ 43–47 $ |

| Disney (DIS) | ~ 113,76 $ | ~ 95–105 $ |

| Intel (INTC) | ~ 29,58 $ | ~ 24–26 $ |

*Beispielwerte für ein Risiko von ca. 8–15 % unter dem aktuellen Kurs.

🇫🇷 Français

| Action (Ticker) | Prix approx. | Stop-loss conseillé* |

|---|---|---|

| Apple (AAPL) | ~ 245,50 $ | ~ 220–230 $ |

| Microsoft (MSFT) | ~ 517,93 $ | ~ 460–480 $ |

| Alphabet (GOOGL) | ~ 254,72 $ | ~ 220–230 $ |

| Amazon (AMZN) | ~ 231,48 $ | ~ 200–210 $ |

| Nvidia (NVDA) | ~ 176,67 $ | ~ 150–160 $ |

| Meta Platforms (META) | ~ 778,38 $ | ~ 700–720 $ |

| Tesla (TSLA) | ~ 426,07 $ | ~ 360–390 $ |

| JPMorgan Chase (JPM) | ~ 314,78 $ | ~ 270–290 $ |

| Johnson & Johnson (JNJ) | ~ 176,19 $ | ~ 150–160 $ |

| Visa (V) | ~ 341,61 $ | ~ 300–320 $ |

| Procter & Gamble (PG) | ~ 156,04 $ | ~ 135–145 $ |

| Mastercard (MA) | ~ 584,16 $ | ~ 520–550 $ |

| UnitedHealth Group (UNH) | ~ 336,69 $ | ~ 280–300 $ |

| Home Depot (HD) | ~ 415,69 $ | ~ 360–380 $ |

| Coca-Cola (KO) | ~ 66,43 $ | ~ 55–60 $ |

| Exxon Mobil (XOM) | ~ 112,82 $ | ~ 95–100 $ |

| Pfizer (PFE) | ~ 24,03 $ | ~ 19–20 $ |

| Bank of America (BAC) | ~ 52,25 $ | ~ 43–47 $ |

| Disney (DIS) | ~ 113,76 $ | ~ 95–105 $ |

| Intel (INTC) | ~ 29,58 $ | ~ 24–26 $ |

*Niveaux de stop-loss donnés à titre indicatif, généralement 8 à 15 % en dessous du prix actuel.

🇨🇳 中文

| 股票名称 (代码) | 约当前价格 (美元) | 建议止损价* |

|---|---|---|

| 苹果 (AAPL) | ~245.50 | ~220–230 |

| 微软 (MSFT) | ~517.93 | ~460–480 |

| 字母表/谷歌 (GOOGL) | ~254.72 | ~220–230 |

| 亚马逊 (AMZN) | ~231.48 | ~200–210 |

| 英伟达 (NVDA) | ~176.67 | ~150–160 |

| Meta 平台 (META) | ~778.38 | ~700–720 |

| 特斯拉 (TSLA) | ~426.07 | ~360–390 |

| 摩根大通 (JPM) | ~314.78 | ~270–290 |

| 强生 (JNJ) | ~176.19 | ~150–160 |

| Visa (V) | ~341.61 | ~300–320 |

| 宝洁 (PG) | ~156.04 | ~135–145 |

| 万事达 (MA) | ~584.16 | ~520–550 |

| 联合健康 (UNH) | ~336.69 | ~280–300 |

| 家得宝 (HD) | ~415.69 | ~360–380 |

| 可口可乐 (KO) | ~66.43 | ~55–60 |

| 埃克森美孚 (XOM) | ~112.82 | ~95–100 |

| 辉瑞 (PFE) | ~24.03 | ~19–20 |

| 美国银行 (BAC) | ~52.25 | ~43–47 |

| 迪士尼 (DIS) | ~113.76 | ~95–105 |

| 英特尔 (INTC) | ~29.58 | ~24–26 |

*止损价仅作参考,通常设置在当前价格下方约 8%–15%,可根据个人风险承受能力或技术支撑位进行调整。