Technology and AI

- Nvidia (NVDA): A major player in AI and semiconductor technology, noted for its strong performance and role in powering AI development.

- Last price: $177.27

- Average target price: $216.24

- High target price: $389.73

- Low target price: $100.00

- Oracle (ORCL): Recently surged due to a major cloud services contract with OpenAI, boosting its profile in the AI sector.

- Last price: $328.46

- Average target price: $323.13

- High target price: $410.00

- Low target price: $195.00

- Microsoft (MSFT): A dominant force in cloud computing (Azure) and AI, known for strong growth potential.

- Last price: $500.37

- Average target price: $624.36

- High target price: $700.00

- Low target price: $485.00

- Broadcom (AVGO): A semiconductor and software company benefiting from high demand in the AI space.

- Last price: $369.57

- Average target price: $365.00

- High target price: $420.00

- Low target price: $253.00

- Advanced Micro Devices (AMD): A key competitor to Nvidia, positioned to benefit from growth in AI hardware.

- Last price: $159.54

- Average target price: $191.86

- High target price: $230.00

- Low target price: $140.00

- Palantir Technologies (PLTR): Specializes in data analytics and AI software, with significant upside potential noted by some analysts.

- Last price: $166.74

- Average target price: $155.57

- High target price: $210.00

- Low target price: $45.00

- ServiceNow (NOW): A cloud-based software company with robust subscription growth and AI advancements.

- Last price: $923.72

- Average target price: $1,153.22

- High target price: $1,300.00

- Low target price: $734.00

Financial and other sectors

- Goldman Sachs (GS): The investment bank showed strong Q2 2025 performance, benefiting from renewed investment banking activity.

- Last price: $769.93

- Average target price: $771.74

- High target price: $820.00

- Low target price: $702.00

- American Express (AXP): Seen as a reliable “defensive growth stock” with steady revenue and high card member spending.

- Last price: $323.43

- Average target price: $342.33

- High target price: $370.00

- Low target price: $290.00

- Booking Holdings (BKNG): An online travel platform seeing continued strong demand and growth in bookings.

- Last price: $5,474.81

- Average target price: $5,807.60

- High target price: $6,260.00

- Low target price: $5,280.00

- Brookfield Corporation (BN): A diversified financial firm focusing on real assets like infrastructure and renewable energy, considered a long-term investment.

- Last price: $67.05

- High target price: $82.96

- Low target price: $47.98

- Lockheed Martin (LMT): The defense and aerospace company offers stability, with a steady stream of contracts driven by ongoing global tensions.

- Last price: $463.835

- Average target price: $548.88

- High target price: $630.00

- Low target price: $415.00

- Taiwan Semiconductor Manufacturing (TSM): As a major chip manufacturer, TSM plays a vital role in the global tech supply chain.

- Last price: $168.04

- Average target price: $177.06

- High target price: $220.00

- Low target price: $145.00

- Intel (INTC): A leading semiconductor company, Intel is a key player in the PC and server markets.

- Last price: $48.06

- Average target price: $46.50

- High target price: $60.00

- Low target price: $40.00

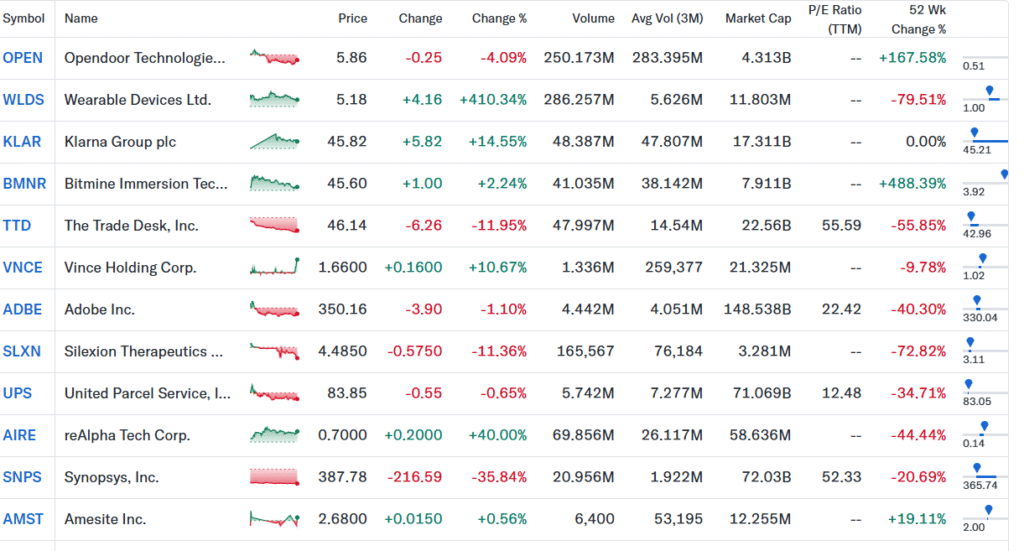

- Adobe (ADBE): Known for its creative software, Adobe is a major player in the digital media and marketing space.

- Last price: $350.16

- Average target price: $438.25

- High target price: $500.00

- Low target price: $330.00

- Salesforce (CRM): A leading cloud-based software company, Salesforce offers CRM and other enterprise solutions.

- Last price: $242.57

- Average target price: $284.81

- High target price: $330.00

- Low target price: $225.00

- Upstart Holdings (UPST): This fintech company uses AI to improve lending practices.

- Last price: $62.42

- Average target price: $82.00

- High target price: $100.00

- Low target price: $45.00

- Arm Holdings (ARM): A leading semiconductor design company, Arm’s technology is used in a vast number of mobile devices.

- Last price: $154.14

- Average target price: $130.00

- High target price: $180.00

- Low target price: $80.00

E-commerce and Retail

- Amazon (AMZN): A dominant force in e-commerce and cloud computing, Amazon continues to expand its reach.

- Last price: $230.33

- Average target price: $265.00

- High target price: $300.00

- Low target price: $200.00

- Walmart (WMT): The world’s largest retailer, Walmart has a significant presence in brick-and-mortar and online retail.

- Last price: $100.41

- Average target price: $110.00

- High target price: $125.00

- Low target price: $90.00

- Costco Wholesale (COST): A membership-based warehouse club, Costco is known for its bulk discounts.

- Last price: $956.29

- Average target price: $990.00

- High target price: $1,100.00

- Low target price: $850.00

- Booking Holdings (BKNG): This online travel platform, encompassing brands like Booking.com, Priceline, and Kayak, benefits from the travel industry’s recovery.

- Last price: $5,474.81

- Average target price: $5,807.60

- High target price: $6,260.00

- Low target price: $5,280.00

Finance

- JP Morgan Chase & Co. (JPM): A leading global financial services firm, JP Morgan is a major player in investment banking and consumer banking.

- Last price: $300.54

- Average target price: $320.00

- High target price: $350.00

- Low target price: $280.00

- Morgan Stanley (MS): This global investment bank and financial services firm has a strong presence in wealth management.

- Last price: $154.12

- Average target price: $160.00

- High target price: $180.00

- Low target price: $140.00

- American Express (AXP): A leading financial services company, American Express is known for its charge cards and travel services.

- Last price: $323.43

- Average target price: $342.33

- High target price: $370.00

- Low target price: $290.00

- Citigroup (C): A global investment bank and financial services corporation.

- Last price: $97.08

- Average target price: $105.00

- High target price: $115.00

- Low target price: $85.00

- Ally Financial (ALLY): A digital financial services company, Ally focuses on consumer banking and auto lending.

- Last price: $48.97

- Average target price: $55.00

- High target price: $65.00

- Low target price: $40.00

Other Sectors

- UnitedHealth Group (UNH): A leading healthcare company, UnitedHealth offers a range of insurance and healthcare services.

- Last price: $346.78

- Average target price: $375.00

- High target price: $400.00

- Low target price: $320.00

- Eli Lilly and Company (LLY): This pharmaceutical company is known for its diabetes and other treatments.

- Last price: $754.62

- Average target price: $800.00

- High target price: $850.00

- Low target price: $700.00

- Netflix (NFLX): The dominant streaming entertainment service, Netflix continues to grow its subscriber base and content library.

- Last price: $1,247.71

- Average target price: $1,300.00

- High target price: $1,400.00

- Low target price: $1,100.00

- Lennar (LEN): This home construction company is a major player in the US housing market.

- Last price: $184.76

- Average target price: $200.00

- High target price: $230.00

- Low target price: $160.00

- Micron Technology (MU): As a leading memory and storage solution provider, Micron plays a key role in the semiconductor industry, particularly for AI applications.

- Last price: $96.85

- Average target price: $110.00

- High target price: $130.00

- Low target price: $90.00

Important disclaimer

Based on their closing prices on September 11, 2025, several stocks in the French stock market showed notable performance:

- Top Performers:

- Kering: Shares of the luxury goods group Kering climbed 2.42%, closing at €239.05.

- Airbus: The aerospace giant Airbus also showed strong performance, with shares rising 2.26% to close at €192.82.

Factors Influencing Stock Performance

Several factors can influence the performance of individual stocks and the broader French stock market. Recent examples include:

- Company News: Corporate announcements can significantly impact stock prices. For example, Kering’s stock rose following an amendment to its Valentino agreement.

- Geopolitical Tensions: Global events can also play a role. Escalating geopolitical tensions in Eastern Europe and the Middle East, for instance, boosted shares of defense giant Thales by 3% on September 10, 2025.

- Sector-Specific Factors: The performance of specific sectors can impact related stocks. The struggles of the luxury goods sector in 2024, for example, have contributed to the CAC 40’s lacklustre performance that year.

Other Major French Stock Indices

Besides the CAC 40, other significant French stock market indices and their closing prices on September 11, 2025, include:

- CAC Next 20: Closed at 11,713.34.

- SBF 120: Closed at 5,927.23.

- CAC All-Tradable: Closing price data not found in the search results.

- CAC Mid 60: Closed at 13,698.94.

- CAC Small: Closed at 15,977.44.

Recent Performance of CAC 40 Components

On September 11, 2025, the CAC 40 index saw gains, closing at 7,822.16. Here’s a brief overview of the

performance of some of its major components:

- Top Performers: Airbus, Sanofi, and Kering were among the top performers.

- Other Movers: BNP Paribas, AXA, and Vinci also recorded positive gains on September 11, 2025.

Important Note: Past performance is not indicative of future results. It is important to

conduct thorough research and consider your own investment goals and risk tolerance before making any investment decisions.