“most active activity for all Types of people in the world”# stock market stock market

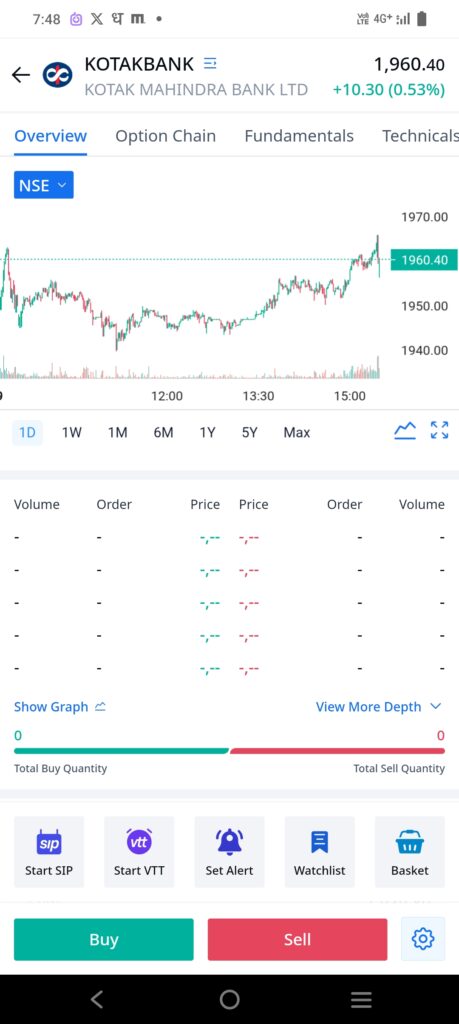

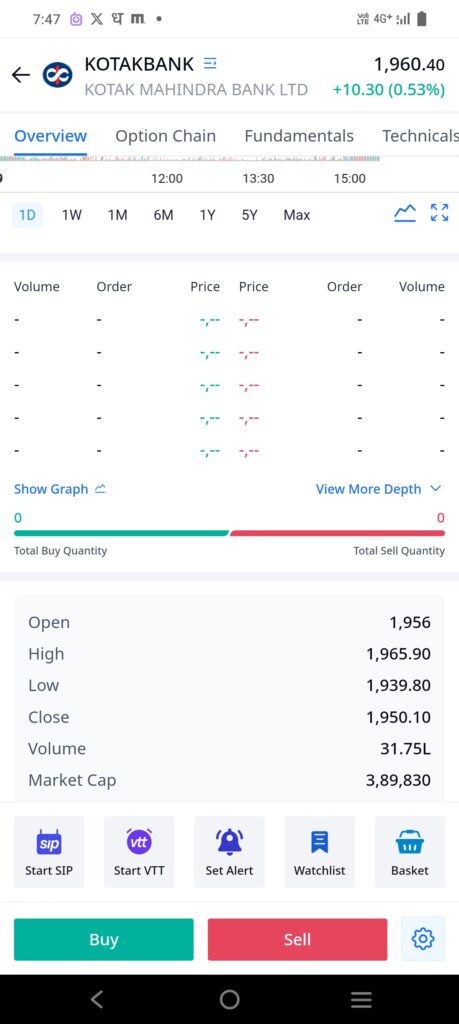

1. Kotak Mahindra Bank

- News: Sumitomo Mitsui Banking Corporation (Japan) plans to sell its 1.65% stake in Kotak Mahindra Bank through block deals.

- Deal Size: ₹6,166 crore with a floor price of ₹1,880/share.

- Impact: Such stake sales usually put short-term selling pressure on the stock because a large number of shares enter the market. However, it doesn’t change Kotak’s fundamentals – it only means a big foreign investor is exiting.

2. Blue Jet Healthcare

- News: Promoter Akshay Bansarilal Arora is selling 1.18 crore shares (6.83% stake) via Offer for Sale (OFS) on Sept 10–11.

- Floor Price: ₹675/share.

- Impact: Promoter stake sale often signals they want to book profits or diversify holdings. For investors, the OFS gives a chance to buy shares at a fixed floor price. Stock could see short-term pressure but long-term impact depends on company performance.

3. Sun Pharma

- News: US FDA classified its Halol plant under OAI (Official Action Indicated) due to non-compliance with manufacturing standards. The plant is also under Import Alert, meaning shipments to the US are blocked (except critical drug shortages).

- Impact: This is negative news. US sales are a big part of Sun Pharma’s revenue, so until the plant is cleared, earnings may be hit.

4. ICICI Prudential Life Insurance

- News: Board meeting on Sept 12 to discuss raising funds via non-convertible debentures (NCDs) through private placement.

- Impact: Raising money via NCDs shows the company wants to strengthen its balance sheet. Neutral to positive development, as it supports growth without equity dilution.

5. HEG (Bhilwara Energy)

- News: Bhilwara Energy acquired Statkraft’s 49% stake in Malana Power Company, making it the sole owner. They also allotted 1.75 crore equity shares at ₹142/share, raising ₹25 crore.

- Impact: Positive for long-term growth as the company gains full control of hydropower projects (278 MW in Himachal Pradesh). However, the stock may remain dependent on investor sentiment in power/energy sector.

6. Bajaj Auto

- News: Company will pass on GST reduction benefits to customers. Price cuts up to ₹20,000 on two-wheelers and ₹24,000 on three-wheelers, effective Sept 22.

- Impact: Positive for demand – cheaper bikes could boost sales. But profit margins may reduce slightly if costs are not adjusted.

7. Sterling & Wilson Renewable Energy

- News: Received Letter of Intent (LOI) for a 300 MW solar project in Rajasthan worth ₹415 crore.

- Impact: Positive – big project win boosts revenue visibility. Renewable energy sector outlook also strong.

8. Samvardhana Motherson International

- News: Its Turkey unit completed acquiring remaining 25% stake in two automotive plastics/tooling companies, making them fully owned subsidiaries.

- Impact: Positive – full ownership gives better control and higher profits from global operations.

9. Thermax

- News: Invested ₹115 crore in subsidiary First Energy (FEPL) for renewable energy expansion.

- Impact: Positive for long-term growth in clean energy business.

10. Bharat Electronics (BEL)

- News: Declared final dividend of ₹0.90/share on Sept 23.

- Impact: Stable PSU company. Dividend shows consistent returns for shareholders. Neutral to mildly positive.

11. Mamata Machinery

- News: Secured third consecutive order worth $1.17 million from UAE for a 9-layer blown film plant.

- Impact: Positive – shows consistent international demand and growing export business.

12. Bikaji Foods

- News: Facing Enforcement Directorate (ED) summons linked to Rajasthan Premier League sponsorship. Company clarified involvement was only sponsorship and all payments were legal.

- Impact: Neutral to slightly negative – ED probe can create short-term sentiment risk, but fundamentals remain intact.

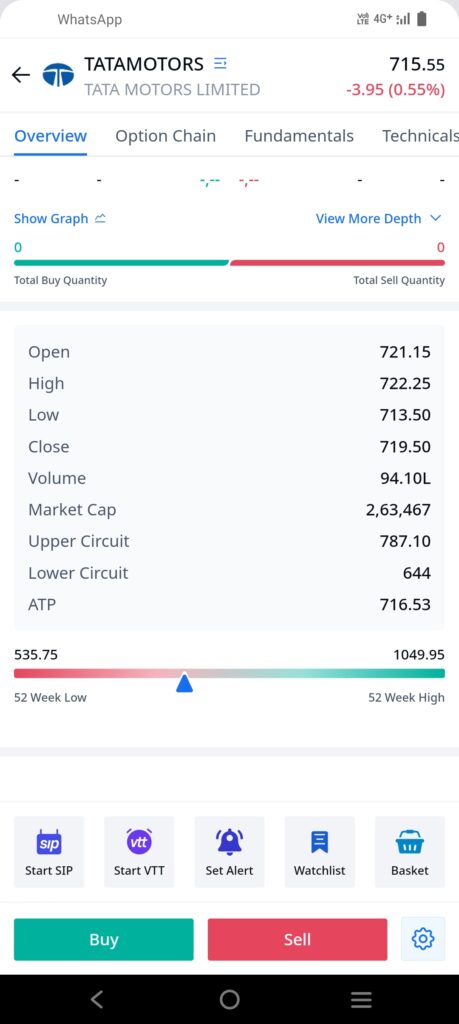

13. Tata Motors

- News: Acquired 26% stake in two SPVs of Tata Power Renewable Energy (TP Paarthav and TP Marigold) for green projects.

- Impact: Positive – strengthens Tata’s push into EV and renewable energy ecosystem.

14. Eicher Motors (Royal Enfield)

- News: Will pass on GST cut benefits to customers from Sept 22 across motorcycles, apparel, and accessories.

- Impact: Positive for boosting demand, especially during festive season.

✅ Overall View:

- Positive Stocks: HEG, Bajaj Auto, Sterling & Wilson, Motherson, Thermax, Tata Motors, Eicher Motors, Mamata Machinery.

- Cautious Stocks: Sun Pharma (FDA issue), Bikaji (ED probe), Kotak & Blue Jet (stake sale could pressure prices).

- Stable Stocks: ICICI Prudential Life, BEL

📈 Stocks That Look Positive for Tomorrow (Sep 11, 2025)

The Indian stock market is showing strong momentum, supported by positive global cues, U.S.-India trade talks, and hopes of an interest rate cut. Here are some sectors and companies that may continue to do well tomorrow:

🧵 1. Textile Stocks (Gokaldas Exports, KPR Mill)

- Textile companies jumped up to 7% today after news that the U.S. may roll back some tariffs.

- If this sentiment continues, Gokaldas Exports and KPR Mill could see more buying interest tomorrow.

💻 2. IT Stocks (Infosys, TCS, Wipro)

- Infosys announced a share buyback that will be discussed on September 11, which has already lifted IT stocks.

- The IT sector also benefited from optimism around trade talks with the U.S.

- Expect continued demand in Infosys, TCS, and Wipro tomorrow.

🚗 3. Auto Stocks (Mahindra & Mahindra, Eicher Motors)

- Both stocks hit 11-month highs after the government cut GST on vehicles.

- With strong momentum, M&M and Eicher Motors may keep attracting buyers in the short term.

🏗️ 4. Metal Stocks (JSW Steel, Tata Steel, SAIL)

- Brokerages upgraded these companies because of lower steel output expected from China, which improves demand for Indian steel.

- JSW Steel, Tata Steel, and SAIL remain on traders’ radar for tomorrow.

Noteworthy Small-Caps with Momentum or Institutional Interest

- Voltamp Transformers

Bought in a ₹360-crore bulk deal by Citigroup and UTI MF—Citigroup picked ~57,000 shares at a slight discount. The stock has delivered a strong 630% returns over the last five years.The Economic Times - Prakash Industries

A small-cap multibagger held by renowned investor Dolly Khanna. It recently announced a final dividend with a record date of September 17—a classic value + dividend play.The Economic Times - Fratelli Vineyards

Rose 5% to hit its upper circuit after a ₹5.5 crore block deal by investor Porinju Veliyath. It’s now in focus as a potential multibagger.The Economic Times - Yatharth Hospital & Trauma Care Services

Noted investor Mukul Agrawal took a 1.14% stake in Q1FY26—highlighting growth potential in the healthcare small-cap space.The Economic Times

Small-Caps with High Growth Potential (Analyst Picks for 2025)

Source: Economic Times – “New Year Picks: 10 smallcap stocks that can rally up to ~53% in 2025”

- Ethos – Upside: ~30%

- DOMS Industries – ~11%

- Axiscades Technologies – ~21%

- Privi Speciality Chemicals – ~18%

- Samhi Hotels – ~31%

- ISGEC Heavy Engineering – ~27%

- Wonderla Holidays – ~30%The Economic Times+2The Economic Times+2Wealth18.com –

These picks span sectors like luxury goods, engineering, chemicals, and amusement/entertainment, all backed by favorable analyst estimates.

Strong Performing Small-Caps Backed by Mutual Funds (2025 Gains)

List of small-cap stocks delivering 50–110% returns in CY2025 and held by multiple mutual funds:

- Force Motors – +110%

- Garden Reach Shipbuilders & Engineers – +94%

- Bharat Dynamics – +68%

- Godfrey Phillips – +54%

- Paras Defence & Space Technologies – +62%

- Blue Jet Healthcare – +52%

- ITD Cementation India – +50%

- Authum Investment & Infrastructure – +50%

- Redington – +50%